BlueScope Steel an excellent Value Company (ASX:BSL)

|

| Port Kembla Source: www.bluescopesteel.com.au |

Trav Mays

Follow @MaysTrav

Description

BlueScope Steel (ASX:BSL) is a “global leader in premium

branded coated and painted steel products - the current largest manufacturer of

painted and coated steel products globally”. BlueScope has 5 major segments,

Australian Steel Products, North Star, Building North America, NZ & Pacific

Steel and Building Products Asia & North America. These segments are spread

out over 17 countries with more than 100 facilities and 14,000 employees.

Whilst having a large array of brands under the BlueScope banner, their main

brands are Colorbond, Clean Colorbond and Zincalume steels, Lysaght steel

building products and Butler and Varco Pruden engineered buildings.

History

BlueScope listed on the ASX on 15th July 2002 after it

split off from BHP and as with many manufacturing companies, it has had a

turbulent ride since then. The share price initially increased from the IPO

price of $11.14 to just over $48 in 2007, before falling to a low of $1.6 in

2012. The effects of the Global Financial Crisis were extended for BlueScope, as the

global economy contracted, the iron ore price increased by an astronomical

amount, from below $40/tonne in 2007 to over $180/tonne in 2010. These high

coal prices along with a strong Aussie dollar and low steel prices lead

Bluescope to post over a billion dollar loss in 2011.

To combat this, Bluescope ceased all exports from their Port

Kembla Mill, resulting in ~800 employees being stood down and a further 200

jobs being lost at the Western Port Steel Mill. Macro conditions improved over

the coming years, however Bluescope continued to struggle to make a profit with

the 90 year blast furnace at Port Kembla, again considering shutting it down in

2015. It was during these deliberations that Bluescope expanded further into

America, purchasing the remaining 50% of the North Star Mill, taking their

control to 100%. This increased their percentage of non-current assets in America from 17%

to 44%. This formed part of

a strategic move away from Australia, beginning in 2010, Bluescope began to

expand into New Zealand, Asia and America, almost halving their percentage of

non-current assets in Australia, 63% in 2010 to 36% in 2017.

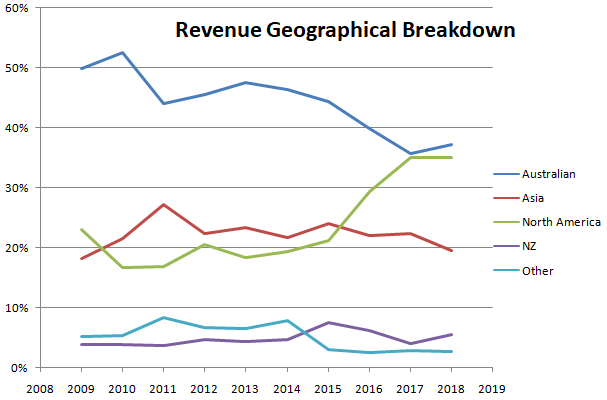

The movement of assets translated into a movement of their revenue base. Revenue sourced from Australia reduced from 53% in 2010 to 37% in

2018, whilst in America it went from 17% to 35%.

One of the largest costs facing Australia at the moment is

electrical costs. BlueScope always looking to the future and for potential

opportunities, has entered into the largest solar Power Purchase Agreement with

ESCO Pacific and Schnider Electric. The 7 year agreement will supply roughly

20% of BlueScope Australia’s Electrical requirements, taking most of the 133MW

output of the Finley Solar farm, located 100km west of Albury.

Competition

The 2017 acquisition of Liberty Onesteel would have been an excellent

opportunity to price BlueScope, however as it was purchased by the private

conglomerate GYG Alliance, the price they paid has been kept a secret.

Nevertheless, BlueScope has many other competitors for comparison, especially with

their further expansion into North America.

As you can see

below, using a number of the common value metrics, BlueScope is by far the better purchase

at current prices. BlueScope is not only ranked the overall best but has the best

values in 7 out of the 11 categories and isn’t last in any of them. US Steel

scored the second lowest, however the difference was still 10 points higher

with the rest scoring double or more than BlueScope. From a business perspective, BlueScope has the highest profit margin and lowest Debt/Equity. In fact, they are

actually net cash positive, with $63 million in cash left after paying off all

of their debt.

The similar Pitroski score shows that the gain in 2018 was

seen across the industry and therefore was a result of outside influences, iron

ore prices, steel prices, Trump’s election and protectionism etc. We therefore

cannot allow the Pitroski score to have much of an impact on the eventual

decision. It also needs to be said, that as a large number of these metrics are

related to price, the lower share price of BlueScope will cause this type of analysis

to favour BlueScope. The cause for the large decrease in share price needs to be

further examined before a final decision can be made.

Evaluation

On a comparison basis, BlueScope is by far the superior steel

manufacturer, however just because it is has scored the best, does not mean

that it is currently mispriced enough to warrant purchase, especially when

taking into consideration the need for a sizeable margin of safety.

Joel Greenblatt made the enterprise value (EV) multiple a

popular analysis technique. By using the average industry and historical

multiples, you can compare the current price with those paid historically and

industry wide. Using the industry average EV multiple of 6.56 results in a BlueScope's share price of $22.6 a 104% increase on current prices, whilst using BlueScope’s 5

year average gives an increase of 83% to $20.27/share. The returns are of

considerable size, however as with all evaluation techniques, these are just a

small component of the overall analysis. The reason for the downbeat share

price needs to be thoroughly investigated.

While share price increases will make up the bulk of any

gains you make once purchasing a business, the total return to the shareholder

including dividends and buybacks is more important. BlueScope has tendered to buyback

shares, which for a long term investor, assuming that the share price during

the buyback is trading below its intrinsic value (read excellent commentary

about that here),

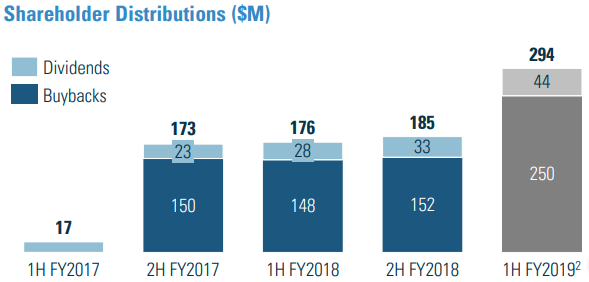

is the best use of a company’s excess capital. BlueScope returned ~22% of its 2018

profits and is set to continue returning value to share holders, having already

begun another $250 mill buyback.

Possible Causes of the Current Share Price

Despite BlueScope earning a large profit, the share price has been

falling from a high of $18.60/share to 52 week lows of $10.56/share.

The potential causes of which are huge, from the dreaded and

unpredictable “tweet” risk to the low AUS/US exchange rate. Below is a list of

potential risks that I believe could have the biggest impact and are therefore

causing the share price to fall.

-

US/The world trade tensions

-

Tweet risk

-

AUS/US exchange rate

-

Trump risk

-

Unstable Australian Government

-

Iron Ore prices

-

Steel Prices

-

China

-

New CEO

-

Global Recession

As you can see, a

large number of these are not BlueScope specific risks but global risks, with the

Trump risk helping to increase short term US profits through tariffs.

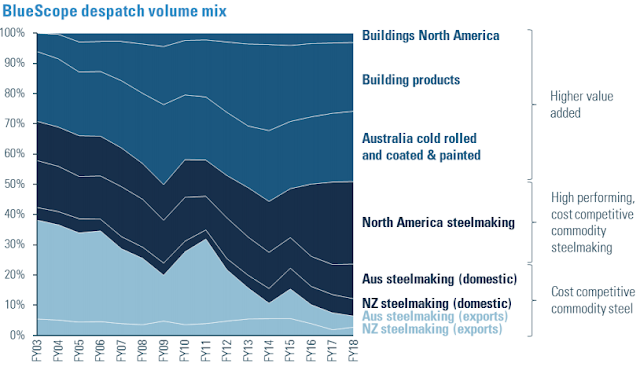

The low AUS/US exchange rate, whilst at one stage would have

had a much larger impact on the Bluescope, has been somewhat mitigated by their

global expansion. As you can see below, Bluescope has decreased the Australian

Steelmaking exports significantly, resulting in the exchange rate only significantly

affecting the cost of internationally sourced or US priced inputs for

Australian manufacturing. The low AUS/US exchange rate will have a positive

effect on the US operations when converted to $AUS.

The appointment of Mark Vassella as CEO was an excellent

choice, given his vast steel industry experience, especially within the US

market. I don’t believe this is having an effect. In fact, it’s my opinion that

it is the uncontrollable effects that are pushing the share price down. The

uncertainty of Trump and the US/China trade negotiations are having a roll on

effect into the iron ore and steel prices. I believe it is these risks that are

causing investors to currently be cautious. Along with this, as with all

industries, China is an ever present behemoth with the ability to create

further chaos for the steel industry. A Chinese economy stimulation package

involving steel production, could cause a large drop in the steel price whilst

increasing the iron ore price; this would obviously have a large impact on

BlueScope. With all the uncertainty a margin of safety is paramount to an

investor’s long term success.

Recommendation

BlueScope Steel, is an excellent example of a value company,

however the reason for the low share price could be warranted. A good

understanding of the major risks is extremely important to facilitate a

realistic risk reward analysis. Fundamentally, whether an Investor chooses to

invest in BlueScope will come down to their global economy outlook. If you are

optimistic, the future is bright, tensions will ease and stability will resume.

However if you are pessimistic, than I would suggest looking elsewhere for an

investment opportunity. I tend to believe the actual outcome will be somewhere

between the two, but more towards the optimistic side of the spectrum. As with

most people I can’t predict the future (read more about that here), I do however

believe it’s time to begin thinking about Warren Buffett’s quote "Be fearful when others are

greedy and greedy when others are fearful".

As a business, BlueScope has very little debt, a global

presence, is net cash positive, ranks higher than other major competitors, is

run by an excellent management team and recently confirmed their 1H 2019

underlying EBIT guidance of 10% higher than 2H 2018 ($745M). They have learnt

from the most recent recession and have reduced their exposure to a given country.

It is due to all of this that I believe that BlueScope Steel will prove to be

an excellent long term investment.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion

of BlueScope Steel, given this, they may be subject to one or a number of

biases, more specifically anchoring and/or confirmation bias. This article is

neither general nor personal advice and in no way constitutes specific or

individual advice. The website and author do not guarantee, and accept no legal

liability whatsoever arising from or connected to, the accuracy, reliability,

currency or completeness of any material contained on this website or on any

linked site. This website is not a substitute for independent professional

advice and users should obtain any appropriate professional advice relevant to

their particular circumstances. The material on this website may include the views

or recommendations of third parties, which do not necessarily reflect the views

of the website or author, or indicate its commitment to a particular course of

action

Location:

Brisbane QLD, Australia