Paragon Care looks cheap, but is it cheap enough? (ASX:PGC)

09/06/2019

Trav Mays

Follow @MaysTrav

Given their ability to forecast

fiscal year results, below I have calculated possible share prices by using

their forecasts and trailing 3 year EV/EBITDA multiple. As you can see, even if they don’t quite make

their FY guidance, a reduction of 5% still results in a 40% gain on today’s

prices. If they can met their guidance it’s a 47% gain and 54% if they can

exceed it by 5%.

Paragon Care (ASX:PGC) was established after some

questionable behaviour by its previous company directors. On the 27th

of September 2005, Citrofresh (Paragon Care’s previous name) stated that “the

use of Citrofresh as a post-coital application will act as an “invisible

condom” for the prevention of STD’s including HIV”. As the share price skyrocketed

to a peak of 70c (opened at 22c) the next day, a former independent director,

Mathew Walker and a former chairman, Ron Gajewski, opportunistically sold chunks

of their shares for ~57c, highs not seen for roughly 4 years. This trade netted

them $577,000 and $281,000 respectively; within 4 months, both had resigned

without disclosing cause. After a couple of director changes and some other

upper level management shenanigans, Mark Simari, the man who would transform

Paragon Care from a sanitary solution company to a Health and aged care

conglomerate was hired (April 2008).

Drawing on his many years of experience as a Director of a

number of investment firms, Mr Simari’s first steps were to change the name of

Citrofresh to Paragon Care and to initiate a 6 point growth strategy,

essentially a roll-up strategy. A fairly predictable move, given Mr Simari’s Linkedin

page states that “my first love has always been, and continues to be, M&A”.The

years he spent at the investment firms gave him all the necessary tools to execute

a roll up strategy, he was very experienced in raising funds, selecting

investment candidates and expanding businesses.

The Corporate Finance Institute describes a Roll Up

strategy as “the process of acquiring and merging multiple smaller companies in

the same industry and consolidating them into a large company”. A strategy that

is effective in markets where there are a number of small players and no large player.

Whilst implementing the roll-up strategy, Paragon Care has emerged

predominantly as a medical and surgical supplier, selling all things medical,

from stainless steel equipment to consumables. An excellent choice of market to

execute this strategy in, as a quick Google search of “medical and surgical

suppliers Australia” shows, 5 of the first 7 results are small family run companies.

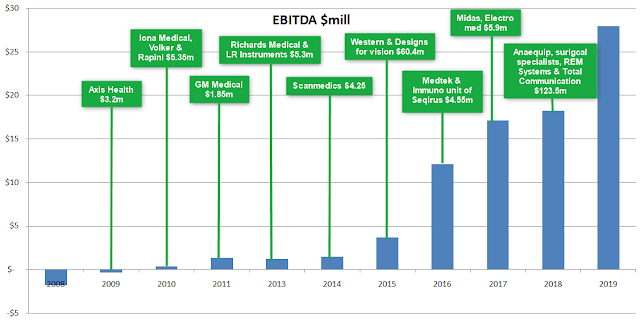

The rollup strategy essentially works, by the

acquiring company purchasing other companies that are trading on a lower

multiple than itself, once assimilated, the market then assigns the higher

multiple to the earnings of the acquired company, pushing the stock price up,

allowing the acquirer to raise more funds/debt, purchase another company and on

and on it goes. Below I have tabulated the acquisitions Paragon Care have made since

2011, as you can see, all were trading on a lower Price/EBITDA multiple than

Paragon Care was at the time (Please note that the price paid in the table is

cash only, it doesn’t include any of the earn out costs).

The speed with which Paragon Care acquired companies would

have resulted in a number of redundant, out dated and overlapping processes all

of which have the opportunity for streamlining, eliminating nonsensical

friction, such as useless paperwork and/or the doubling of forms and data

between separate systems. The elimination of friction within an organisation is

an easy and at least at the beginning, easily identified form of organic

growth. To oversee this form of growth requires a different type of manager to

Mr Simari and in January 2018, he handed the reigns over to Mr Andrew Just. Mr

Just brings with him over 25 years of global healthcare industry experience,

having worked in high managerial roles at companies such as GE Healthcare,

Cochlear and Radiometer. Paragon Care subsequently announced that the “major

acquisition program is largely complete” and that they

would now be focusing on a 9% organic growth target.

Mr Just earned a black belt in Six Sigma whilst working at

GE Healthcare, which would have equipped him with the necessary tools to eliminate

the nonsensical friction. Six Sigma fundamentally,

is a set of techniques and tools that allow the practitioner to eliminate or

reduce defects and waste, thereby continuously improving any process. But in

practice it is more than that, it retrains the brain, giving the practitioner a

new viewpoint with which to see problems and formulate solutions. Typically to

obtain the Six Sigma accreditation, a person needs to have a mentor, sit an

exam, have worked in a process role for 3 years and to have done 2 Six Sigma

based projects, not an easy task. Along with this training, Mr Just spent 2 of

the 6 years working at GE Healthcare, a company that Jack Welch infused the Six

Sigma dogma within its culture, as an internal business consultant, where he

taught and lead six sigma projects, specialising in change management.

Drawing on his many years of experience generating organic

growth, one of Mr Just’s first inward focused initiatives was the elimination

of 14 different financial, operational, HR, payroll and reporting systems and

instead incorporating them all into the one system, Microsoft Dynamics 365.

Dynamics 365 is an Enterprise Resource Planning (ERP) and Customer Relationship

Management (CRM) software package, that is predicted to save Paragon Care ~3m

in FY20. Having worked at a company similar to Paragon Care and seen the impact

that Dynamics 365 can have on reducing friction for both employees and for the

customers experience, I believe it will have a big impact on Paragon Care,

helping to unlock pent-up organic growth.

By implementing the roll up strategy, Paragon Care

has taken advantage of all the typical M&A advantages, such as, larger product offerings, the

possibility of cross selling, increased geographical foot print, quicker

access to whole new markets etc. These advantages are than multiplied during a

roll up strategy, it’s like M&A on steroids, it does however work both

ways, multiplying the potential pitfalls by just as much. A quick summary of

the excellent article on Investment Masters Class titled “Roll up Roll up –Circus Tricks”, which states that whilst some of the

investing grates such as George Soros have made considerable amounts of money

by identifying roll ups at their early stages; investors need to be wary of

roll ups at the end of the acquisition phase.This is because as growth comes

from acquisitions, as soon as the acquiring company begins to struggle to

generate more funds or find suitable companies, the business falls over.

So what causes a roll up to stop? Any number of

things, a slowing economy, risk adverse investors, marco instability, the

credit cycle or something as simple as a questionable acquisition, anything that

lowers the acquires margin and/or cuts off their supply of capital. In Paragon

Care’s case, it was self inflicted, they changed the company strategy to inward

growth and subjected themselves to stricter acquisition requirements. This

change in strategy can explain some of the recent reduction in share price; another

possible cause for some of the price reduction is their inability to divest the

loss making legacy capital equipment business. This legacy business is having a

material impact on Paragon Care, losing $9.28m after tax in the first half of

FY2019. Initially stating that they would sell the capital equipment business

as a whole, after being unsuccessful, on the 30th April Paragon Care

conceded and announced that they would sell it off as parts, aiming to have the

sales finalised by 30th June 2019.

Another cause of the down beaten share price could be

due to questionable acquisitions. One potential hazard that Jack Welch

describes in his book “Winning” is the need for cultural fit. Mr Welch states

that cultural fit is as, if not more

important than strategic fit (emphasis mine). Having worked at a company that

had been acquired a couple of years prior to my arrival by a company very

similar to the makeup of Paragon Care, albeit within a different industry, I

have seen the ramifications of a cultural misfit, as Mr Welch says “The fact is

some cultures don’t combine, they combust”.

Since its implementation of the roll-up strategy,

Paragon Care has acquired a number of companies, the majority of which were

similar to the core theme, the standout exception is Midas Software

Solutions. As you can probably guess from their name, Midas is a software

company. They help to streamline the reporting process of certain heath care

faculties by as much as 10mins per report, helping to save (according to the

Midas website) between 1 – 2 hours per doctor per day. Having neither worked at

Paragon Care nor Midas, this is pure speculation, but the culture at a software

company would surely be far different to that of an equipment wholesaler. They

do work within the same industry, but the cultural misfit that I worked for was

not only within the same industry, but was doing a very similar thing, both

selling capital equipment to many of the same customers. This could be one of

the components causing the delays in the development of the MIDAS business,

which to date has not lived up to expectations. That being said, a good

strategy is 10% planning and 90% implementation, so that whilst it may be more

difficult, an excellent management team could easily pull it off.

To evaluate a culture at an organisation, I typically check

Glassdoor. Unfortunately, neither Paragon Care nor Midas have any entries on

Glassdoor, so an investigation into my speculation above has come up fruitless.

Paragon Care does however have Google reviews, so we can at least get a slight

feel of whether or not they are a customer focused organisation. With an

average score of 3.1 from 13 reviews, I’d say that’s pretty good. Clearly not

the best sample size, but I believe big enough to get a somewhat realistic

view. Google doesn’t give exact dates of reviews, but it’s possible to arrange

by review date. Review 1 was made over 2 years ago, reviews 2 – 9 were done

over 1 year ago, with the final three being sporadically entered over the past

year. As you can see below, after a initial score of 5, their average was

brought down quite quickly by two 1’s (1 is the lowest score you can give), but

has since trended upwards, quite encouraging, as people are less likely to give

good reviews than bad (check out The New York Time’s article titled “Why you can’t really trust negative online reviews” for some good info and some handy hints to

combat this).

Market

Paragon Care currently has ~3% share of a~$9bn addressable

market opportunity (Paragon Care’s target market is roughly 70% of the medical

and surgical supplies segment of the health and aged care industry), a small

fraction of the $190b spent on healthcare in Aus and NZ annually. A yearly

spend that is only going to increase with time. The Australian Bureau of

Statistics (ABS) states that ~15% of the 24.6m people living in Australia today

are 65 or over, ~3.7m people. Australian is an aging population, with the 65

and over demographic growing at a disproportionate rate to the rest of the

population. The ABS predicts that the percentage of people 65 and over will

increase to ~17% by 2027. Along with the increase in the percentage of

Australians over 65, the general Australian population is also increasing. Over

the past 10 years, this growth rate has been roughly 1.6% year on year (YoY).

To give us a rough guide on how many people there will be in 2027, using the

more conservative and longer YoY growth rate of 1.4%, seen between 1975 and

2006, the Australian population will have increased to ~28m with the 65 and

over population reaching ~4.7m people.

Discussion

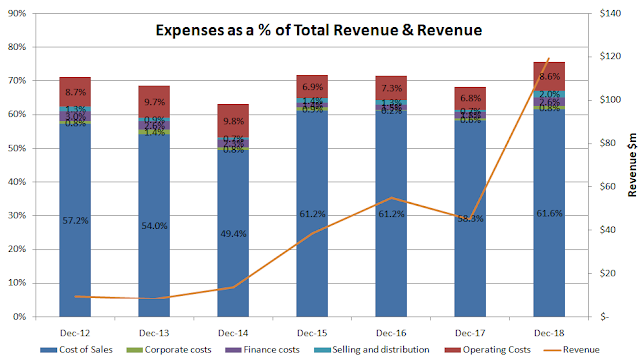

During a roll-up strategy, as so much focus in pointed

outwards on inorganic growth, it is easy to allow companies to run rampant on

expenses. As you can see below, up until HY2019, Paragon Care has done an

excellent job of keeping costs at roughly the same level of revenue. HY2019 saw

an increase in expenses across the board, no doubt a result of the heavy level

of acquisition seen in 2018.

Along with the expenses increasing, total management

compensation also increased, despite earnings per share decreasing. But when we

step back and look at the general compensation trend, a different story

emerges. Total management compensation has increased by ~33% between 2011 and

2018, whilst Earnings per share has increased by ~30x or ~3000%. To put that

another way, in 2011, 6.97% of revenue was going towards management compensation,

compared with 2018’s figure of just 1.11%.

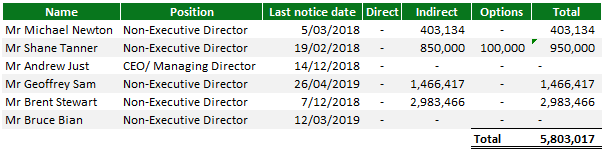

Whilst management hasn’t purchased any shares recently, the

last two purchases were by Brent Stewart and Geoffrey Sam around the start of

December 2018, increasing their total shares held by 100,000 and 50,240

respectively. At the time of purchase, the share price was at ~$0.62, a ~40%

premium on today’s prices. Not only that, but they already had quite

considerable positions, at the time of purchase, their holdings were worth

$1.86m and $0.91m. These two make up the bulk of the management ownership,

together they own 2.2% of Paragon Care, whilst the combined management team

owns only 2.9%. Not the level of skin in the game that I like to see, but not

as bad as others and I have been burnt before despite large insider ownership

(read about that here).

Whilst management might not own many shares, they have paid

out a pretty good dividend since its introduction in 2013. Increasing it year

on year since 2013, they paid a dividend of $.0301 in 2018, which equates to a

payout ratio of 57%. Assuming they continue the second half dividend increase

in FY2019, they are currently trading at a dividend yield of ~7.6%, not too

bad. Using the Gordon growth model with a 5% growth rate and a cost of equity

of 12%, equates to a price of $0.48, a 9% gain on today’s prices.

Evaluation

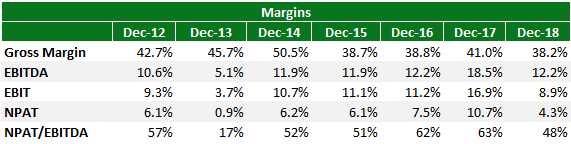

When we look at the Half year metrics, we can see a mix

result, some better than HY2018 such as P/Sales and others not as good, such as

Return on Assets (ROA) and Return on Equity (ROE). These numbers obviously need

to be viewed lightly, since the $125m spent on acquisitions in 2018 is having a

large affect on them.

Margins have declined this half, but again, this is to be

expected as Paragon Care has acquired a number of companies recently and hasn’t

to date, had sufficient time to bring them all into the fold. The general trend

between 2015 and 2017 is however quite encouraging.

Paragon Care recently confirmed their $240m revenue and $28m

EBITDA guidance, but can we trust their forecasts? One simple way to check is

to go back over their past predictions and see how successful they have been.

Over the last five years, Paragon Care has met and in some cases slightly

exceeded all of their half year forecasts, which is quite reassuring.

Risk

Paragon Care is not without its risks. During a

company roll up, whilst earnings may be increasing, many companies have a hard

time converting it to cash. Matt Brazier commented on this phenomenon recently in his investment diary (link here). He stated

that “Some companies' profits are subject

to more approximation than others. For example, serial acquirers make more

estimates and adjustments than most because buying companies is messy. Roll-up

companies are also cash hungry as they must continuously buy other businesses

to grow. For these reasons it is particularly important to analyse cash flow of

roll-ups”. He then went on to say that “I have avoided Paragon Care Ltd

(ASX:PGC) in recent years for the same reason”. On that same day, I was reading

Peter Lynch’s book “Beating the Street” and he also happened to mention that an

investor needs to pay more attention to cash for companies that have acquired a

lot; clearly the universe was talking to me.

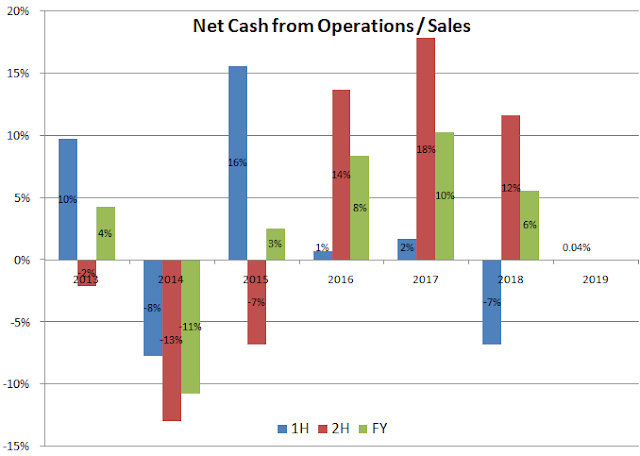

When

we look at Paragon Care Net Cash from Operations by sales ratio, you can see

why Mr. Brazier has stayed clear. Prior to 2016, Paragon Care has had trouble

converting sales into cash, they do seem to have changed though and assuming

they do turn most of the focus inwards, I imagine a more stable and healthy

level of cash/sales in the future.

Another thing of note, was from a recent McKinsey

article titled “Why the biggest and best struggle to grow” which stated that whilst acquisitions

“can drive a material amount of top-line growth in the relatively short order,

it is now widely accepted that the average acquirer captures relatively little

shareholder value from its deals. In fact, the numbers suggest that even

an acquirer who consistently enjoys a top-quartile market reaction in each of

its deals will create only about $0.20 in shareholder value for every $1

million in revenues acquired”, clearly not the best endorsement for the roll-up

strategy. However, this is talking in generalities and about companies that are

already of considerable size, as I stated earlier, the health and aged care

supplier market appears to be one that is a good candidate for the roll up

strategy, or is confirmation bias kicking in again?

Conclusion

Mr Simari has done an

excellent job of turning a shell company with a shady past, into a health and

aged care conglomerate. The choice of Mr Just to replace him and oversee the

new direction of piecing all of Mr Simari’s work together seems like a good one. The

market is currently growing and Paragon Care has positioned themselves to take

advantage of its current fragmented state.

This investment doesn’t come

without risks though, all the figures I have used are from the continuing business,

the legacy business continues to drag down earnings. Even if they are able to

sell it before June 30th, it would have already had a material

impact on FY19. Along with this, the desire to sell could cause them to sell it

off cheaper than it deserves. Another thing to think about is that within the

evaluation section, I have used the 3 year trailing EV/EBITDA multiple, but are

these multiples justified? The market placed those multiples on a company

executing a roll up strategy, not looking inward for growth. Will the market

still use such multiples, or will it place more conservative values on it in

the future? I don’t know. I do however think that there are currently too many red flags for me to invest. Maybe once the FY results are released I will re think this decision, but at current prices, Paragon Care isn't offering enough return for all this uncertainty.

If you liked this and would like to read more, I have started working on a series about inflection point investing, read my first post about XRF Scientific here and the second about Korvest here and don't forget to subscribe, so you don't miss out on my upcoming posts. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

Thanks for reading

Just Culture Investor

Trav Mays

Sources:

The author is not a current owner of a portion of Paragon Care, they may however still be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action

Location:

Brisbane QLD, Australia