Looking for trouble at RCR Tomlinson (ASX:RCR)

|

| Darling Downs Solar Farm |

14/08/2019

Trav Mays

Follow @MaysTrav

1. https://www.rcrtom.com.au/about-rcr/

RCR Tomlinson (ASX:RCR) recently entering voluntary administration, whilst potentially devastating to a large number of people, the thousands of employees and

shareholders especially, offers a great learning opportunity. This post

will try and identify any potential early warning signs that we may be able to

use in the future when examining businesses. This post won’t be an examination

of the managers or the operations of the business, it will be an investigation

searching for any early warning signs within the financial statements only.

Whilst doing this examination, I

have tried to put myself in the position of the shareholder. However, given

that I know the final result I am obviously heavily influenced by hindsight

bias. With this in mind, I would like to make it apparent that I am in no way

criticising any person for either purchasing or hanging onto their shares.

Whether a person decides to purchase or to retain a portion of a business is

governed by many things, such as their risk tolerance, expertise, level of

knowledge, etc. I have made many mistakes, mostly recently Donaco (read about

that one here), my desire is to learn from

history (it’s a shame that we learn more from mistakes than successes), not to

criticise any market participant. Unfortunately learning from history is easier

said than done, as Mark Twain said “History

doesn’t repeat itself but it often rhymes”.

Company

RCR is a 120 year old Australian

Engineering and Infrastructure Company, working with some of the world’s

leading organisations to provide intelligent engineering solutions to the

Infrastructure, Energy and Resources sectors. “RCR’s core capabilities

encompass; development, engineering, procurement, construction (“EPC”),

operation and maintenance of major infrastructure and resource projects. These

include power generation plants (using a wide

range of fuels; solar, wind, battery and hydro), water and waste treatment systems, rail and road tunnel infrastructure, rail signalling and

overhead wiring systems, mineral processing and material handling plants, integrated oil & gas services

(both onshore and offshore), supply of RCR proprietary materials handling and process equipment,

and property services including facilities management, HVAC and electrical services”1.

They have had a wild ride in the

stock price, recently reaching highs not seen since just before the 2007 bust

and the 2014 oil price dive with a subsequent fall similar to that seen in 2008.

|

| RCR Tomlinson's Share Price |

Warning Signs

Gross Margin

The gross margin showed clear

signs that something wasn’t right at RCR and that further analysis was

warranted. As you can see below, after improving their gross margin to a very

impressive 9.9% in 2014, it fell dramatically, to 5.1% in 2016 and continued on

its downward trajectory to 1.34% in 2018.

|

| RCR Tomlinson's Share Price |

Gross margin between 2018 and

2015 was being squeezed due to a disproportionate increase of revenue (93%) and

cost of sales (111%). As you can see in Table 1, the main culprits up to 2018

for the increase were materials and other costs with employee benefits further

exacerbating the expense in 2018.

|

| RCR Tomlinson's Cost of Sales |

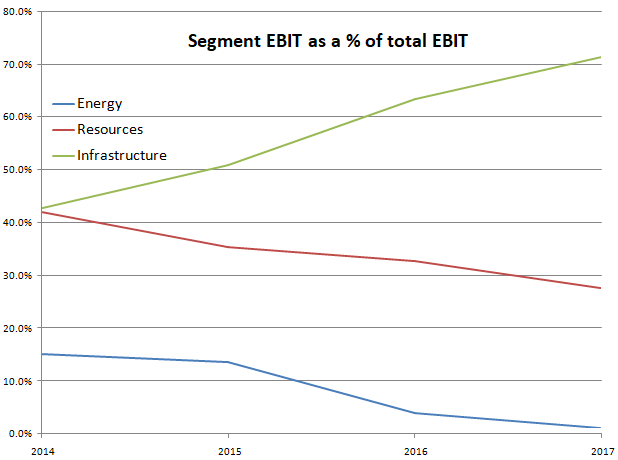

Breaking this down further in to

RCR’s operating segments, it is clear that the initially it was just the energy

segment, reducing its EBIT margin to 1% from 5% in 2016. The energy and resources

segments include RCR’s power generation and mining operations, as with all

companies operating in these segments, they were hit hard by the extreme drop

in the oil price in 2014. The 2018 recovery of energy would be partly due to

the recovery of the oil price, with WTI crude reaching a high of US$74/barrel, still

far shy of the pre 2014 crash highs of US$105/barrel.

|

| RCR Tomlinson's Gross Margin |

One of RCR’s main core

capabilities of the infrastructure segment is the renewable energy systems,

where they offer all engineering facets, design, construction, commissioning,

operation and maintenance. Whilst the administrators are still examining the

firm’s financials for the cause of their recent troubles, it is believed that

RCR took on renewable energy contracts without a firm understanding of

connection risks. Along with this, it has been stated that they offered fixed

contracts, resulting in all project over run costs being borne by RCR. These

two underlining issues came to fruition in 2018, resulting in a large loss for

the infrastructure segment of $9.8mill, far below the trailing 4 year average

profit of $30mill. This is especially troublesome for RCR, as over 70% of their

EBIT in 2017 was generated in the infrastructure segment.

|

| RCR Tomlinson's Segment EBIT as a % of Total EBIT |

Trade and other payables

Another troubling sign was the

huge increase in trade and other payables, increasing from 35% of equity in

2016 to 110% in 2017. Between 2009 and 2016, trade and other payables was an

average 46% of equity, between 2017 and 2018 it increased to 116%. Interestingly,

as their trade bills increased they continued to pay down their borrowings,

reducing their borrowings/equity ratio by an impressive 73.5% between 2014 and

2018.

|

| RCR Tomlinson's Debt/Equity |

Discussion

In 2016, the reduction in gross

margin could be attributed to an unfortunate project running over time and/or

cost, but when the trend continued in 2017 a deeper evaluation was clearly warranted.

This evaluation would have unearthed the huge increase in trade and other

payables, this along with a shrinking margin should have been a huge red flag

for owners, signalling that something wasn’t right. It’s easy to type this

after the fact, I too could have been persuaded by the rising share price, as

it trotted it was up to a 249% increase in a year and a half. Along with

this, a lot of great analyst believed the same and typically when they are all

in agreeance, they are usually right. Unfortunately on this occasion they were

not.

I could continue to say things

such as they should have renegotiated their debt and paid down their trade and

other payables, focused more heavily on increasing the energy margin, or sold

it off as it was only making a small percentage of EBIT, but these and other

similar statements are built on assumptions made on hearsay and speculation. We

will need to wait for the report from the administrators to make a full

examination.

The main thing I learnt from

this analysis is that trends hold the key to finding issues and signs of areas

that require a deeper dive into the weeds. It also further highlights the need for us to do

our own analysis and to not be swayed by share prices. Once the analysis has

been completed, then compare it to the price you calculated, if it is too high,

sell, if it’s low and gives you a good margin of safety, buy.

I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.1. https://www.rcrtom.com.au/about-rcr/

This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action