Has Korvest reached an inflection point? (ASX:KOV)

22/04/2019

Trav Mays

Continuing on our search for companies at inflection points, today we will be examining Korvest, they have been improving their results, but are they at an inflection point? Read on to find out.

Before we begin, this will be a flow on from my last post

covering XRF Scientific,

I highly recommend that you read that post first, it also gives a short summery

of Matt Joass’

article on inflection point investing.

Company

Korvest (ASX:KOV) is a combination of 4 businesses, their

most profitable is the EzyStrut cable tray manufacturer, but they also have a

galvanising business in South Australia and the Power Step and Titan

Technologies companies in Brisbane. Having listed in 1970, their results have

been similar to all businesses tied heavily to the expenditure cycle, up and

down as they ride the expenditure wave.

As the wave has been trending down in recent years, Korvest’s

results have followed suit, their troubles were further exacerbated by the rising

zinc prices (a key ingredient in galvanising). As you can see below (sorry

about the graph, not the cleanest ever done), the price of zinc

increased quite substantially between 2016 and 2017 (65.6%), whilst industry

expenditure stayed fairly flat, at levels 27% lower than 2 years prior. These

two forces culminated in the loss of 2017 and the ousting of the general

manager Alexander Kachellek, who had overseen the business for 10 years. Please

note that whist on the graph the zinc price has decreased in 2019, this is

only the price until Dec 2018, it has since trended higher to ~ US$3000/tonne

(As of 17/04/2019).

Korvest breaks their business up into two segments,

industrial products, which includes EzyStrut, Titan Technologies and Power step

and Production, which includes their galvanising business. When we look at the

individual segments, it’s clear that the lower expenditure is having a material

impact on both segments, with the rise of zinc prices hurting the production

segment even further.

As with XRF, Korvest has had some tailwinds in recent years,

helping to lift their profits higher. The main one is the increase in

expenditure, as the old adage states, “A rising tide lifts all ships”. Another

has been the decrease in zinc prices, helping to improve margins in the

production segment. The lower dollar also helped Korvest, making the cheaper

imported competitors more expensive.

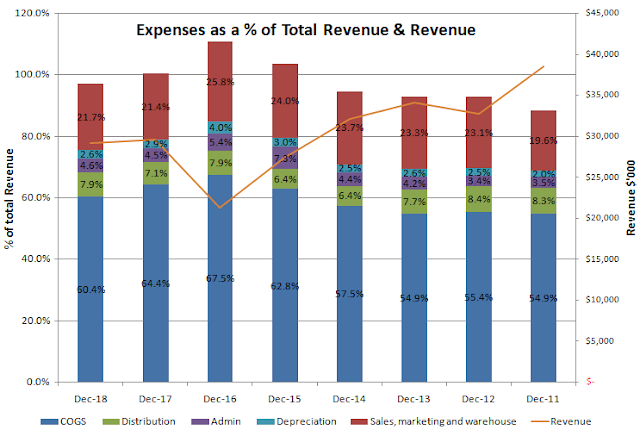

Discussion

Within the XRF post, I referenced a Forbe’s interview with Peter Cuneo, in which he

stated “there are three elements to a successful turnaround, cost cutting,

organic growth and strategic leaps”. Unlike XRF, KOV doesn’t appear to be

ticking all the boxes, expenses as a percentage of revenue have decreased, but

revenue appears to have stayed fairly stable over the half, be it slightly

lower. KOV have stated that they have had a number of price increases in recent

years, pushing the higher zinc and energy prices onto consumers. These price

increases seem justified, especially when considering the wholesale price of

electricity in Adelaide has increased by 220% in 4 years (Dec 2014 31.5/MWh;

Dec 2018 101/MWh) and the wholesale price of gas has increased by 219% (Dec

2014 $3.25/GJ; Dec2018 $10.37/GJ). Whilst these increases are warranted, they

do however show that the slight decline in revenue must have resulted from a

disproportionate decline in sales volume.

Whilst sales volumes may have decreased, a quick look at the

expenses makes it appear that they have done well to reduce COGS, but the

actual decrease achieved by KOV has been heavily affected by the decrease in

Zinc prices. The other thing of note within the expenses, is that whilst

volumes may have decreased, distribution costs have increased; increasing by

8.9% pcp (Dec 2017 $2.11 mill, Dec 2018 $2.298 million). Which could be

attributed to larger and/or more difficult items to transport or rising

transport costs, it’s just something of note.

What about strategic leaps? Well, unfortunately KOV hasn’t

ticked this box either, but that’s not from lack of trying. In 2014, KOV

initiated a two part growth strategy; the first part was a further push into

the export market and the second part was focusing on growth through acquisitions.

To ensure they had ample manufacturing capacity to meet the predicted increase,

they sold off their less profitable Indax handrail and walkway business to free

up manufacturing space in their Kilburn plant for the more successful EzyStrut

business.

During 2015 and 2016, KOV continued to search for potential

acquisitions, their initial screen found 60 potential companies, 12 of which

they spoke to and of these 12, 3 were presented indicative offers, all were

unsuccessful. The 2 years of negotiating came to a total after tax cost of

$475K in 2016 and a declaration that all “M&A activity paused until

business conditions improve”.

During the search for acquisitions, they also focused their

efforts on expanding further into the New Zealand, Philippines, Singapore and

Hong Kong markets. During this time, they obtained DNV certification for their

products, allowing them to be used on offshore oil and gas rigs and installed a

local subsidiary in Singapore with representation. However the success of the

Singaporean subsidiary was not as expected and with the margins being squeezed,

KOV wrapped up the subsidiary just a year later (2017), saving ~$400K per half.

Along with these growth strategies, KOV initiated a cost saving initiative, one

of the areas of focus was the employee head count, reducing it by 18% in the

first half of 2016 (June 2015, 225: Dec 2015, 184) and 66% from their peak 6

years prior (2010, 306).

Despite the manager director’s best efforts, he was

unsuccessful in achieving the growth the board required and with the loss of

2017, it was only a matter of time before they called for his resignation.

September 2017 was when he handed the reigns over to the interim CEO Chris

Hartwig, who was then appointed the CEO in February. Chris has been within the

Korvest group since 2006, starting off as the general manager of the

galvanising business before moving to the EzyStrut business where he worked as

both general manager and executive general manager.

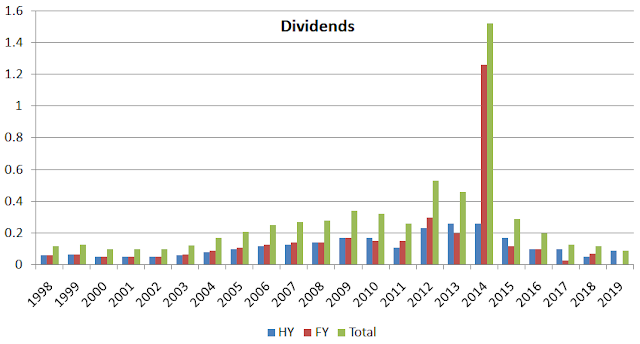

Despite the troubles Korvest has had over recent years, they

have managed to continue to pay a dividend, mind you, nothing like what they

paid out in 2014 (2014 includes the 100% franked special dividend of $1.00 per

share). If we were to price Korvest on their dividend alone and assuming they

continue to pay a second half dividend of at least equal to the first half,

usually higher, but to keep it conservative, we will assume they keep it the

same, Korvest has a current dividend yield of 6.67%, pretty good. Using the

Gordon growth model with a growth rate of 5% and cost of equity of 12%

calculates a price of $2.57 a 4.76% drop from today’s prices.

Given that we are (roughly) at the start of the upward phase

of the expenditure cycle, is a growth rate of 5% realistic? Not really, between

2003 and 2011, Korvest increased the dividend at an average rate of 11% per

year. We are however starting from a higher dividend then in 2003 (2003 .125;

2019 .18), so using a more realistic/conservative growth figure of 7, we come

to a price of $3.6 a 33.33% increase on today’s price.

Evaluation

Looking at the half year value metrics, it’s clear that

Korvest has posted their best half since 2014. EPS has more than doubled when

compared to 2017, not only that, but they are getting a better return on both

equity and assets and they are trading at an EV/EBITDA not see since 2012.

Along with the increased return on both assets and equity,

margins have continued to trend higher.

When we look at the segment PBT margin, both have increased

quite considerably, production by 2% and industrial products almost doubling.

Whilst still not close to the PBT margins of yesteryear, due to the changing

market, I believe these types of margins have gone the way of the dodo. The

increased competition across all businesses and reduced expenditure, has

resulted in an abundance of unutilised production facilities, further squeezing

margins. As a local manufacturer, they have had a distinct advantage against

international competition, the low dollar. However, as Korvest doesn’t

typically service the low cost market, this tail wind is having less of an

impact than expected.

To price Korvest, along with the Gordon Growth model above,

I have tried to calculate the price at the top of the coming cycle. Korvest has

achieved a FY EBITDA over $7.5mill in 3 of the last 12 years and an EBITDA over

$6.5mill in 8 of the last 12 years, I have therefore used these values in my

valuation as they are achievable. Using these and the 12 year average EV/EBITDA

multiple of 5.8, we arrive at valuations of $4.3 and $3.73, which using today’s

prices, results in a gain of 66% and 43%. Quite large gains. Given that

investors typically attach higher multiplies at the top of cycles, these

figures are most likely, still somewhat conservative.

Conclusion

If I was to invest in Korvest, it would not be as an

inflection play but as a cyclical one. Whilst they have tried to decouple

themselves from the Australian expenditure cycle, they have unfortunately

failed. Rising fixed costs have squeezed margins in recent years and whilst

some of these costs have been pushed on to consumers, an increase in the level

of competition means we won’t be seeing margins similar to those seen just a

few years ago anytime soon. Another thing I’m concerned about is the increase

in the prices, these increases were done at a time when the Aus dollar was depressed,

if/when the dollar rises back to its highs during the last cycle top, will they

still be able to keep their margins and compete with the cheaper imported

products? I have no idea, but my gut tells me it will be hard.

Due to all of this, and my inability to predict the cycle,

let alone the top, means that I have no idea how long it will be before we see

the 66 and 43 percent gains calculated above and then when you add to that the

time value of money, I believe I can find better investments elsewhere, XRF scientific for

example. If however you are more experience with cyclical investing, this is a

good place to start your own review, worst case, you receive a pretty good

dividend whilst you wait for those gains.

If you’d like to read more about inflection investing, I

recommend Matt Joass’ article titled “The hidden power of inflection points” and for a

company currently at or near an inflection, check out my article on XRF Scientific. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

Sources:

- Gas and electrical information gathered from https://www.aer.gov.au

- https://www.forbes.com/sites/robertreiss/2011/08/22/why-9-of-10-turnarounds-fail/#697aff6a3f5d

- https://mattjoass.com/2018/11/10/inflection-point-investing/

The author is not a current owner of a portion of Korvest, they may however still be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action

Location:

Brisbane QLD, Australia