Learning from Laserbond (ASX:LBL)

02/07/2019

Trav Mays

Follow @MaysTrav

LaserBond (ASX:LBL) recently hit an inflection point, after

some excellent management decisions and some tailwinds, shareholders have been

rewarded with a 244% gain over the past year. Today we will be investigating if

there are gains still to be made and to see if there is anything we can learn.

LaserBond first come to my attention whilst researching XRF Scientific (click here for that post). A

number of excellent articles, such as Mr. Joshua Baker’s on Livewire titled “A platinum crucible in the rough”,

compared XRF to Laserbond. So ever keen to learn more, especially about

inflection point investing, I decided to dive deeper to see what nuggets of

knowledge I could uncover.

Company

LaserBond, originally called HVOF Australia P/L, was founded

by Mr. Gregory Hooper (Currently Executive Director) in 1992, working out of a

small workshop in Ingleburn NSW. (HVOF stands for High Velocity Oxygen Fuel,

which is a type of thermal spray system that uses combustion to heat and propel

particles near supersonic speeds. These high flying particles collide with a

material, forming an extremely high density low oxide coating.) Gregory’s

brother, Mr. Wayne Hooper (Currently Executive Director) joined HVOF in 1994

and together they were at the forefront of laser cladding innovation, building

one of the first high-powered cladding systems using a 6kW CO2

laser. In 2007 they listed on the ASX and changed their name to LaserBond

Limited, listing for $0.2 per share and a market cap of just over $13 million.

The capital raised from their listing was quickly put to

use, they invested in R&D and purchased Peacheys Engineering in Gladstone

Queensland for $3m in 2008, as an attempt to capitalise on the growing gas

industry. Unfortunately for LaserBond, the Queensland division wasn’t able to

get any traction, the global financial crisis hit and then the large increase

in activity within the Gladstone region pushed both rents and employee expenses

up immensely. After a number of bad results, in 2013 they sold off 5 large

pieces of equipment and their order book for $750,000, ceased all machining and

fabrication work within the area, moved a number of other pieces of equipment

to NSW and continued to do surface engineering work for the region from their

NSW premises.

Whilst the Queensland division wasn’t doing very well, the

rest of the business was, in fact they were doing so well, they had to move

their NSW facility from the original workshop to a larger facility in Smearton

Grange, just to keep up with orders. Not only that, but after 12 months of

trials, LaserBond had signed a Memorandum of Understanding (MoU) with Gearhart

United, within which, Gearhart committed to exclusively commissioning LaserBond

for all their laser cladding work. To accommodate this large influx of work (estimated

at the time to increase revenue by $1.2m, a 12.75% increase to FY2013’s revenue),

LaserBond established a South Australian branch and to ensure the success of this

branch, Mr. Gregory Hooper was later relocated to head it up (October 2014). Whilst

the business was doing well, it wasn’t enough to compensate for the Queensland

divisions loss; in 2013 LaserBond wrote off the remaining $3.6m in goodwill and

posted an adjusted Net Profit after Tax loss of $0.72m.

It was shortly after all this (February 2014) that the

chairman, Mr. Timothy McCauley decided to step down. Having started back before

LaserBond had IPO’d, he had done an excellent job during some extremely

difficult times. Mr. Allan Morton was appointed his successor in March 2014,

which in my opinion, is when the seeds for the 2018 inflection point were

planted.

Mr. Allan Morton an Engineer by Trade, obtained his Bachelor

of Mechanical Engineering from the University of Technology in Sydney, later going

on to obtain an MBA from Harvard Business School. Prior to starting at

LaserBond, Mr. Morton had worked as an engineer at CSR and successfully moved

up the ranks to the operations manager role. After this he worked at a number

of companies in high executive roles and/or founded a number of his own companies.

Not of any real importance but interesting nonetheless, he worked for 3 years

as a general manager for a company called Quickflix limited, which had the very same idea as

Netflix. Having started out as a company that shipped the latest DVD’s and

Blu-ray’s through the mail (they still do this), they have evolved into a

streaming website, offering all the latest blockbusters, on a subscription

basis, either online or via the mail! I had never heard of these guys and I am

not sure if they are still operating, as they delisted from the ASX at the

start of 2017, but their website is still up and running and it looks like they

have some new movies on there, so it looks promising. Might be worth checking

out if you are looking for another subscription or have had enough of Netflix.

Anyway, one very interesting and relevant role he had, was as a founding

partner of Waypoint Strategies (Founded in 2010), a consulting group that specialises in

turnarounds. Which is just the type of manager LaserBond needed at this time in

its history.

LaserBond started off as an innovator at the cutting edge of

the surface engineering industry, they had however become complacent, drunk on

the profits from the mining expansion, they had taken their focus off the

company’s vision, “To be a global

leader in the research, design and implementation of advanced surface

engineering technologies”. This is clearly seen in their R&D spend

below, after spending $0.57m (16% of revenue in 2007), the R&D spend for

the 5 years between 2009 and 2013 was reduced to almost nothing, with 2013

actually being $0.

Mr. Morton came on board and

changed all that, with the following couple of years reading straight out of a

turnaround play book. Having divested the unsuccessful QLD branch, they reduced

expenses (they implemented Lean Manufacturing in 2014), they focused on organic

growth and started to reinvest in themselves, more specifically, the core of

the business, its research and development department.

LaserBond kicked a lot of goals

over the next couple of years, so to keep this post short, I have condense them

to dot points:

- Feb 2015: They created a new class of Down-the-Hole (DTH) hammers and associated drilling components that last 2.44 times longer than the average DTH hammer, which equates to a 7% saving on the total drilling cost.

- The lean manufacturing techniques they implemented in December 2014 improved the 2HY 2015 gross margin of the NSW division from 49.3% to 53.2% pcp.

- April 2015: DTH hammers begin testing in European geothermal wells

- July 2015: Laser bond splits into three divisions, Services, Products and Technology. The Services division continues their core surface engineering work, the Products division to continue to manufacture specialised products and the Technology division to oversee the licensing of its technology to non-competitive international markets.

- October 2015: Lodged two international patents on a ground breaking laser cladding process, using the laser deposition method

- FY2016 Increased investment in themselves, more specifically employment, Advertising and research and development

- May 2016: Entered an agreement of collaboration with the University of SA

- August 2016: Awarded $3.22m over three years from the Commonwealth Government to fund the design, building, installation and commission of a dual robotic multi-axis handling system, which included a 16kW laser.

- September 2016: Enters first technology licensing contract with a crushing equipment manufacturing company in China. LaserBond is to deliver a turnkey package with all work done in-house from design to commissioning for $1.45m. The contract also includes 5 years of training and support, in return for a revenue based fee.

- February 2017: Awarded $2.616m as part of a three year collaboration with the University of South Australia and Boart Longyear (total govt fund $8.266m) to extend wear life of critical pieces of mining equipment.

- February 2017: Signed a non-binding strategic partnership to pursue mutually beneficial commercial products and services with Boart Longyear

- FY2017 report: Products division became profitable

Other

includes R&D and Technology divisions

- September 2017: Mr Allan Morton steps down as Director

- August 2018: Signed a Technology licensing agreement with a UK multinational engineering company

- December 2018: LaserBond breaks into the US Steel Industry market with their Composite Carbide Steel Mill Rolls, which typically deliver 5 to 15 times the life of a standard roll.

All of this laid the groundwork for the huge increase in

earnings per share for the first half of 2019, see above. Before I go into my

evaluation of LaserBond, I would like to take a moment and see if there was

anything that should have stood out, in the hopes of spotting the next company

about to hit an inflection point.

The Pursuit for Baggers

LaserBond’s share price ,after hovering around the mid-teens

for the past couple of years, exploded around the mid of 2018, gaining 244%

between the 24/06/18 and 17/02/19.

I for one didn’t see this coming, but that doesn’t mean

others didn’t, take the person who goes by the handle Wini on Strawman.com (If you

aren’t familiar with Strawman.com, I highly recommend you check it out,

excellent source of investment ideas and you get to see what some beasts of the

investment world, such as Wini are currently interested in. Think of Hotcopper

without the trolls), this person literally posted about LaserBond three days

before it started its climb, Talk about timing!

So what should we be looking for? Mr. Christopher Mayer in

his book “100 Baggers: Stocks That Return 100-to-1 and How To Find Them”, studied all of the stocks that

where at least a 100 bagger (when you see bagger after a number, in this case

100, it is referring to a return of 100 – 1, I think it was coined by Peter

Lynch, feel free to correct me if I’m wrong in the comments) between 1962 –

2014, of which he found a total of 365 that weren’t tiny to begin with. He then

investigated these 365 companies further, in the hopes of finding commonalities

and found that they all had some if not all of the following 6 ingredients.

1.

Start small (but not too small, median sales

figure was ~$170m)

2.

Low multiples preferred

3.

High returns on capital

4.

Owner operators

5.

They invested in themselves and

6.

Long time horizon; compounding

So I thought it would be fun to explore each of these six to

see which, if any LaserBond had leading up to the huge increase in share price.

1. Start Small

LaserBond in 2018 generated $15.6m

in revenue, a profit of 1.25m (excluding the inventory write-off) and had a

market cap of $12m, so they had the first characteristic covered. Revenue and profit

both had been increasing since 2015 (2016 profit decreased due to their large

investment in themselves) with HY2019 alone producing $10.5m in revenue and

$1.2m in profit. They have a goal to increase revenue to $40m within 3 years,

still a long way to go, but there have been some quite encouraging developments

recently. After taking a large dip in 2016, their profit margin has returned to

their historical average of the high 7s and in HY2019 had actually increased it

to 10.8%.

2. Low Multiples preferred

Starting from a low multiple

gives any earnings growth an extra boost to the share price. As opposed to

starting from high multiples, where a slight decrease in the earnings growth

rate, can place 2 downward pressures on the share price. Starting from a low

base helps to slingshot the share price higher. It’s like an alley-oop in

basketball, the increase in the growth rate puts up the shot and the increase

in the multiple slams it in the net.

In 2017-2018, LaserBond had a P/E

of around 10, a price to sales of less than 1 and an EV/EBITDA of around 5, all values that a typical value investor

would purchase the share. This is especially true if you are a fan of Tobias

Carlisle as he says an EV/EBITDA score of 5 or below is cheap, not quite as

cheap as the deep value stocks he typically looks for, which have a score of 3

or less, but a cheap stock nonetheless. If we look back to 2014’s values, we

can see that they are very similar to those seen in 2017 – 2018, which makes we

wonder if I had of bought at this time, would I have continued to hold for

those 4 – 5 years, especially with the 2016 drop in earnings?

3. High Returns on Capital

High returns

on capital is about the quality of the business and management’s ability to

find and execute projects that generate high returns. Clearly to get a return

of 100 – 1 the company will need to be able to generate good returns on capital

over a long period of time. There are a number of ways to calculate returns on

capital, I prefer Returns on Invested Capital (ROIC) and as you can see above,

LaserBond has been able to generate quite high values in recent years. The same

can be said about their Returns on Assets (ROA) and their Returns on Equity (ROE).

So again, they have this one covered.

4. Owner Operators

A leadership

team that conducts its self as an owner operator is far better at creating

shareholder value than a team that is purely motivated by money. This is

because by motivating the executives with purely monetary gain, you are

essentially shifted the focus from the longer term projects that produce real

and lasting shareholder value to the short term goals that bring about no

shareholder value but ensure the executives are hitting their KPI’s and

receiving their bonuses. If you have ever had a side gig or run your own

business, you know the difference you feel about the work when you are doing it

for yourself, as opposed to doing it because you are paid.

One way to

look for an owner operator leadership team is to look for companies that are

still being run by the founder. LaserBond was no longer being run by the

founder, he had been put into a position that better suited his skills, as the

head of R&D, but his brother, one of the original company employees was

still running it.

Another way to

see if the executives are shareholder focused is to see if they own a large

percentage of the company, this way, both shareholders and executives gain when

they generate shareholder value. LaserBond’s executive team at the time owned

23 – 24% of all outstanding shares, with the Hooper brothers making up the bulk

of the owner ship. This is very encouraging.

5. They invested in themselves

LaserBond,

after a couple of years of neglect have been continuously investing in themselves

since 2014, with another big investment in 2016. The fruits of which can

clearly be seen.

6. Long Time Horizon

This one has

to do with it taking a long time to reach a return of 100 – 1 as it takes time

for the company to capitalise on its previous good work and then build on it

and capitalise and then build on it and over and over. Clearly LaserBond have

done well to continue to build on the momentum they started back in 2014, with

the share price now showing a more realistic valuation of the company than in

the past.

Mr. Mayer’s research emphasises

the power of small cap value investing, look for well run small companies, that

are currently mis-priced (low multiple), with a management team that is aligned

with the same goals as the shareholders and hang-on through all the ups and

downs, simple J

(Disclaimer: I don’t believe you should buy a company and just hang on, if you

see changes to the fundamentals and/or the story has changed, a re-evaluation

is needed). LaserBond was this type of company in 2017 and 2018. I think this

is one that a typical value investor would have purchased if they had turned

over the right rocks, it’s just a manner of overturning enough rocks until you

find one as good as LaserBond. Easy to say in hindsight, I know, but it doesn’t

help to beat yourself up over missing a stock.

Evaluation

LaserBond is a great company,

well run, good returns on capital and have had some large wins in recent times,

most notably their expansion into the American Steel industry, but that doesn’t

mean that they are currently miss-priced enough to warrant purchasing.

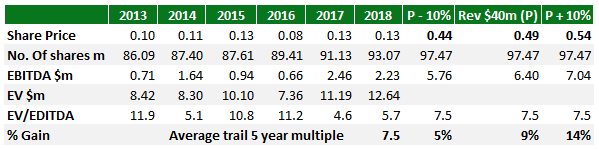

LaserBond has stated on a number

of occasions that they are aiming to generate $40m in revenue within the next 3

years, using this, their NPAT margin and the trailing 5 year EV/EBITDA multiple

we can try and approximate a figure the market would place on this result.

LaserBond in 2018 had a EBITDA margin of just 14.3%, they have however said that

they are working on increasing this margin (it was 17.9% in 2017), so I have

instead used 16%. I have also increased the number of shares using the past 5

year growth rate and also used the trailing 5 year EV/EBITDA multiple of 7.5.

As you can see below, if they are able to achieve their revenue goal of $40m

and the market assigns a historical margin, we are looking at a 9% gain on

today’s prices, 5% if they miss it by 10% and 14% if they exceed it by 10%. If

they instead assign a multiple of 10, we are looking at gains of 20%, 26% and

33%, respectively.

Whilst I have calculated that the

share price is currently between priced about right and a number that I believe

doesn’t offer enough of a safety margin for me to purchase, I am reminded of Matt Joass article on inflection point investing,

where he explains the human brains inability to extrapolate anything other than

linear forecasting very well, see below. I am wondering if I am falling into

this trap now, maybe I am working off estimate 2 or 3, when I should be working

off estimate 4.

| Image source: https://mattjoass.com/2018/11/10/inflection-point-investing/ |

Conclusion

Mr. Morton did a great job helping to refocus LaserBond on

their core business, the results of which are clearly beginning to bear fruit.

They have divested the non-profitable parts of the business and grown

organically whilst reducing expenses and have achieved a HY2019 EPS just shy of

the EPS produced for FY2018. I do however believe the market has repriced the

company about where it should be, given the recent developments and their

growth. They did generate $10.5m of revenue (45% increase pcp) in the first

half, but given that their revenue is close to 50% first half 50% second half,

they will still need to double that in both halves before they reach $40m

revenue, not an easy task, but definitely achievable.

I set out to do this post to try and learn from other people’s

successes. Instead it has reignited my belief in value investing, but at the

same time, emphasised the need to look for companies going through inflection

points. Missing a small percentage of the upside is better than purchasing and

holding out for years in the hopes the market might see the mistake it has

made. It has also shown me that I need to spend more time on Strawman watching

what other great investors such as Wini are doing, reading their reviews on

companies and learning what I can from them.

Whilst I missed the ship with LaserBond, it’s great to see

that there are potentially still mispriced companies out there, especially

given how long this expansion has been going on for.

If you liked this and would like to read more, I have started working on a

series about inflection point investing, read my first post about XRF Scientific here, the

second post about Korvest here, the

third about Paragon Care here and don't forget to subscribe, so you don't miss out on my

upcoming posts. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point

Thanks for reading

Just Culture Investor

Trav Mays

Sources:

The author is

not a current owner of a portion of LaserBond, they may however still be

subject to one or a number of biases, more specifically anchoring and/or

confirmation bias. This article is neither general nor personal advice and

in no way constitutes specific or individual advice. The website and author do

not guarantee, and accept no legal liability whatsoever arising from or

connected to, the accuracy, reliability, currency or completeness of any

material contained on this website or on any linked site. This website is not a

substitute for independent professional advice and users should obtain any

appropriate professional advice relevant to their particular circumstances. The

material on this website may include the views or recommendations of third

parties, which do not necessarily reflect the views of the website or author,

or indicate its commitment to a particular course of action. The author could

change their opinion on any of the holdings at anytime and are not under any obligation

to update the website if/when this occurs.