Still Learning from LaserBond (ASX:LBL)

26/08/2019

Trav Mays

Follow @MaysTrav

Laserbond (ASX:LBL) has just released their latest results and what a cracker, exceeding their earlier guidance, the market has rewarded them with a 17.7% jump in the share price.

I recently wrote a post about LaserBond, within which I highlighted some of the great work they have been doing over the past couple of years, so I won't go over that detail here. Feel free to check that one out first if you aren't familiar with them. I will instead go over their latest result to explore, in a little bit of depth, where I went wrong in my original thesis. I will also update it accordingly and attempt to calculate if LaserBond is under, over or priced about right at the moment.

Company

LBL has more than doubled their earnings per share this year, generating just shy of $0.03 per share, up from $0.13 in FY2018.

The bulk of this increase came from the products sector; PBT increased by 233%, whilst Services increased by a smaller, but still very impressive 20%. The technology division didn't record any revenue in 2018, its growth rate is therefore undefined. Trust me on this one, please don't check it.

Math Joke :)

These results are amazing, but the real standout in the report, in my opinion, is the level of LBL's operating leverage. Operating leverage, for those who may not know, is a companies ability to disproportionately increase operating income with an increase in revenue. When we look at each segment's pcp growth rate, products looks to be the segment with the largest operating leverage, a 62.8% increase in revenue resulted in a 232.8% increase in profit before tax.

To calculate the degree of operating leverage, we simply divide the growth rate of EBIT by the Growth rate of revenue. As you can see, Products has a higher Operating Leverage than Services, with every 1% growth in revenue adding 6.36% growth to EBIT. Services is whilst lower, is adds an impressive 3.1% to EBIT for every additional 1% on the revenue line.

This high level of operating leverage seeps down into the margins, helping to lift them all and take the overall EBITDA margin to an all time high of 21.6%.

A high degree of operating leverage is the result of relatively low variable costs and relatively high fixed costs. As fixed costs, as their name would suggest, are fixed irrespective of the number of units produced, an increase in the production rate will spread the fixed cost out more thinly, thereby reducing fixed costs per unit and subsequently total costs per unit. The cost per unit equation is therefore

Operating leverage is however a double edged sword, helping to boost profits when revenue increases, but if sales are not high enough to pass the break even point, they can have a large impact on profits. A simple way to think about the power of operating leverage is by imagining an underutilised factory. If we have 4 machines and 2 workers, employing 2 additional workers to operate the 2 unused machines wont increase expenses very much, management, front of house, building expenses etc are already being covered, but the additional workers, after some training, will double output, thereby halving the fixed cost per unit. The obvious conclusion from this simple example is how does a company make their factory or workplace more efficient? The crux of the problem is the elimination of pain points or wasted movements, things that are currently being done but could be eliminated. From a top level viewpoint, things such as complicated software or the company layout to things at the individual employee level, desk layout or time management. This is one area that LBL has excelled in. They implemented Lean manufacturing back in 2014, purchased new equipment and have put on an arvo shift for both facilities, the results of which has increased margins across the business.

The tricky part is that we are not privy to a companies constantly changing fixed to variable cost relationship or a breakdown of the number of units sold. We are however given information such as when companies purchase new equipment or implement Lean manufacturing, but the impact is rarely passed onto owners. We must therefore make several assumptions about the operating leverage when forecasting and we all know what assumptions make out of you and me.

Total cost per unit = (Fixed Cost/no. of units) + Variable costs

Operating leverage is however a double edged sword, helping to boost profits when revenue increases, but if sales are not high enough to pass the break even point, they can have a large impact on profits. A simple way to think about the power of operating leverage is by imagining an underutilised factory. If we have 4 machines and 2 workers, employing 2 additional workers to operate the 2 unused machines wont increase expenses very much, management, front of house, building expenses etc are already being covered, but the additional workers, after some training, will double output, thereby halving the fixed cost per unit. The obvious conclusion from this simple example is how does a company make their factory or workplace more efficient? The crux of the problem is the elimination of pain points or wasted movements, things that are currently being done but could be eliminated. From a top level viewpoint, things such as complicated software or the company layout to things at the individual employee level, desk layout or time management. This is one area that LBL has excelled in. They implemented Lean manufacturing back in 2014, purchased new equipment and have put on an arvo shift for both facilities, the results of which has increased margins across the business.

The tricky part is that we are not privy to a companies constantly changing fixed to variable cost relationship or a breakdown of the number of units sold. We are however given information such as when companies purchase new equipment or implement Lean manufacturing, but the impact is rarely passed onto owners. We must therefore make several assumptions about the operating leverage when forecasting and we all know what assumptions make out of you and me.

One other thing that was excellent to see is their continued focus on R&D. They actually increased their R&D spend in FY19, which will no doubt lead to new products, helping to further push future profits higher. (Mining expenditure for 2019 hasn't been released yet).

Evaluation

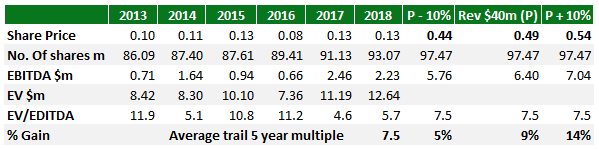

In my previous post I used a simple method to try and calculate a possible share price if/when LBL reaches their $40m revenue milestone. Within which I used a conservative EBITDA multiple of 16%, which was in the middle of the HY19 and FY18 EBITDA multiples. I failed to take into account LaserBond's operating leverage, if I had, I would have used a higher multiple, probably around the 17.9% earned in HY19, but still no where near FY19's 21.6%.

I have reused that same analysis here, but have updated it to a higher EBITDA multiple of 21%. I have again used their $40m milestone (predicted to be achieved in 2022), the 5 year trailing EV/EBITDA multiple of 8.7 and a multiple of 10. If they are able to generate $40m and maintain these multiples, we are looking at gains from 28% to as high as 55%.

These are some very encouraging potential gains, which leads us to our next question. How likely is it that LBL will be able to generate $40m in the next 3 years? That is after all what this thesis has been built on, without which, it holds up about as well as a wet tissue.

LBL has been very forthcoming with their projected sales growth in all three segments, but more specifically within the services and technology segments. We can therefore use these and their $40m in revenue milestone to calculate the rate of growth required in the products segment and conclude from this, if , in my opinion, it is feasible. In their FY19 annual report, LBL stated that "it is expected the Services Division will continue to deliver growth in revenue at similar rates", having grown at 11.3% this year, we will therefore use a compound annual growth rate (CAGR) of 11% over the next two years. Within the technology division, their "target is to provide one additional equipment sale during FY20 and two each year from FY21" which "provide revenue of approximately $1.2-$1.7 million". Along with the initial sale revenue, each piece of equipment comes with "ongoing consumables supply for the term of each agreement with each piece of equipment supplied capable of using up to $1 million per annum in consumables". We will therefore assume each unit sells for $1.5m and generates in consumables, $1m for a full year and $0.5m in the year it is purchased. With their sale of a unit in FY19, they currently have 2 units in operation. The unit's will also be generating a licensing fee which I haven't included (LBL states this will be worth hundreds of thousands per year per contract, but didn't give any figures), but I believe by using the top end of possible consumable revenue we should be OK. I think we may still be somewhat optimistic in the consumables part of the analysis, they already have one unit in operation, but all of the technology division's FY19 revenue is made up of $1.95m from the sale of the unit and $0.415m in consumables for that unit, no consumables on the original unit. But as you can see they sold the unit for $1.95m this year, $0.45m more than what we will be assuming, I therefore believe that it will iron itself out.

When we put all of this together, we can see that the Products Division is going to need to grow by $7.6m between now and 2022, which will require a CAGR of 22% per year, which seems fairly resonable. They grew by over 60% this year, so 22% shouldn't be too much trouble.

However, the larger a company gets, the harder it is for them to grow, so where will this growth come from? Their newest product, which appears to be their main focus for the growth, is their carbide steel mill rolls. They successfully broke into the North American market this year, which according to LBL is over 15 times larger than the Australian market. In FY19, LBL sold $0.285m worth of steel mill rolls in Australia, assuming that they are able to get the same level of market share in North America by 2022, this will contribute $4.27m towards the targeted $7.6m. I'm not suggesting that they will necessarily penetrate the American market to the same level as Australia by 2022, but when we play around with a sum of the parts analysis using (in my opinion) reasonable assumptions, we can get to $40m pretty quickly. That being said, I'm reminded of the Mr. Ronald H. Coase's quote, "If you torture the data long enough, it will confess.”

To try and determine if LBL is currently over, under or priced right, I have reused the revenue analysis above and expanded it to try and calculate future EPS values, assuming the NPAT margin stays flat at 12.1%. As you can see, if we attach a P/E of 20 (which I think seems pretty reasonable given the growth of LBL) we have a PEG of 96.2. As I'm sure you all know, Peter Lynch said a PEG of 100 represents a company that is perfectly priced, it appears that the market is assuming margins will stay pretty steady in FY20.

But is steady margins a reasonable assumption? LBL has made a number of changes in 2019, most of which effects wouldn't be seen in FY19's report, they include

- Increased the SA shop floor staff by 33%,

- Put on an arvo shift at both sites, which is still expanding and

- Increased P&E by $2.41m in the second half. This included an automated dual station high power LaserBond cladding system and a CNC horizontal borer, which doubled the horizontal boring capacity.

We can therefore, using FY20's revenue estimated above, a P/E of 20 and a range of potential FY20 NPAT margins, estimate a range EPS growth rates and from this PEG values. If we assume a NPAT margin will increase to 13%, EPS would have grown by 29%, which results in a PEG of 66.9, indicating that LBL is currently undervalued.

Conclusion

In my original post, I concluded that LBL is an amazing company that has achieved remarkable results, the poster child of a turnaround. But I believed that the market had priced LBL pretty well, hedging this statement by referencing Mr. Matt Joass' article on inflection points and our inability to extrapolate anything in any way other than linearly. I stated "I am wondering if I am falling into this trap now, maybe I am working off estimate 2 or 3, when I should be working off estimate 4". I did work off estimate 2 or 3 because I missed LBL's operating leverage, I didn't realise just how long their lever is and therefore missed out on the roughly 40% gain since I wrote that, just under 2 months ago.

Am I succumbing to the same issue again? I don't think so, but I could be succumbing to a different issue. We all know Mr. Buffet's quote "What the wise do in the beginning, fools do in the end", maybe this is the end and I'm just a fool chasing a return I missed from earlier in the year. Did I unintentionally use too high a NPAT margin to justify my answer? Maybe, that would fit in nicely with me being a fool, especially when we consider that there is a limit that can be levered out of operations. If we continue the above example, once the 2 additional employees have been hired, the company will need to purchase new equipment and/or start to do a lot of overtime, both bringing down the Op Lev value. Employing techniques such as Lean Manufacturing helps, but with each new improvement, they bring with them a diminishing level of return. Having said that, the large CAPEX purchases happened in the second half of FY19 and there is still room to expand the arvo shift and therefore "fill up a few more machines", further reducing the fixed costs per unit. I therefore think that there is still value at these prices, assuming that LBL can hit their revenue growth rates and continue to expand the margins.

So what did I learn? I learnt that whilst I failed to think about LBL's operating leverage, the root failure was not thinking like a business owner. If I had, operating leverage would have been something I definitely would have thought about, especially with all the improvements they have been making. Which would have influenced my evaluation, but would it have been enough to over come my anchoring on the prices from less than a year ago? I hope so, but that's an impossible question to answer. It's easy to forget that we are business owners, especially when you aren't privy to all the info and aren't on site, but it is definitely something I need to pay more attention to.

As always, thanks a lot for reading. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

Thanks for reading

Just Culture Investor

Trav Mays

Sources:

1. https://mattjoass.com/2018/11/10/inflection-point-investing/

The author is a current owner of LaserBond, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action. Please refer to Disclaimer page for a full list of disclaimers.