You can’t predict. You can Prepare; Cellnet HY update (ASX:CLT)

Trav Mays

Follow @MaysTrav

During my initial analysis of Cellnet, I did not consider the impact the lowering of the dollar would have on Cellnet. Howard Marks says “You can’t predict. You can Prepare”. Whilst the lowering of the dollar may be unpredictable, it should be included in a pre-mortem, allowing an investor to require an adquate safety margin. I believe that the underlying thesis for Cellnet is still good, there most likely wasnt a large enough safety margin when publishing my initial thesis.

If you are interested in the retail industry, you can also read my opinion on Shaver Shop and The Reject Shop. I am on Twitter Follow @MaysTrav and Linkedin if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

Today we will be examining Cellnet’s HY2019 results; a recent drop in share price of roughly 27% just after the results were released got my attention, so I put the kettle on, sat down at my desk and dived into the numbers.

Before we get stuck in, I recommend if you haven’t read or

want a refresher, my original Cellnet article can be found here.

Description

A ~27% drop in the share price

roughly a week after a report is released is quite worrying, with the typical

things going through my head, What did I miss? How could I have got it so

wrong? etc, compounded by the fact that I hadn’t had a chance to read it yet,

let alone analyse it.

Yahoo Finance,

retrieved 24/02/2019

Fortunately for me, I have been

reading a lot of Howard Marks lately, statements such as “The biggest investing errors come not

from factors that are informational or analytical, but from those that are

psychological” were still in the front of my mind. Armed with this and other

powerful logical insights from Howard Marks, I calmed myself down and inverted the situation,

maybe instead of looking at it as a potential mistake, I should look at it as a

possible chance to average down.

HY Report

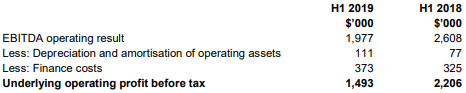

Looking at the first page, it’s

clear that H1 2019 is not going as well as H1 2018, with a reduction in

underlying operating profit before tax of ~32.3%.

Positively they have seen an

increase in revenue of 20.8%, when excluding the Turn Left acquisition, revenue

still increased by 6.5%. A very positive sign, however they have clearly

allowed expenses to blow out. Cellnet acknowledges this and attributes the

decline in operating profit to the reduced dollar’s impact on materials,

packaging and consumables used (AUD/USD has reduced from .78 to .71 in the past

year, with it hovering around .71 over the past 6 months). They also wrote off $0.405mill of Turn left’s inventory, included in

materials, packaging and consumables. Never one to take a person on their word

(especially company directors, no matter how reputable or respected they may

be), below I have tabulated Cellnet’s HY expenses as a percentage of revenue. It’s

clear that there has been a large increase in materials, packaging and

consumables, ~3.7% above the trailing 4 year average (~2.8% when adjusted for the inventory write-off). Within the report,

Cellnet stated that “Measures have been taken in December 2018 to mitigate this

impact”, which is encouraging, a reduction of 1% in expenses, sees an

additional $0.522mill added to the profit before tax. Looking at the other

expenses Cellnet has reduced their employee benefits, finance costs, freight

expenses and occupancy expenses, a total reduction of 0.77% of revenue, which

is excellent. The increases, D&A includes a $0.212mill in customer and

supplier relationships acquired with Turn Left, materials explained above and

warehousing expenses due to the increase in inventory. Which brings us on to

the next section, the statement of financial position or better known as the

balance sheet.

Below I have tabulated interesting sections of the 2018 and

2019 HY balance sheets, along with the percentage change (%Δ)

and also their % of total assets. Straight away you can see huge increases in

assets, with inventory and trade and other receivables more than doubling, some

of which can be attributed to the Turn Left acquisition, but not all. The

reduced dollar, I would have thought, would be a time to reduce inventory stock

levels, not more than double them. Is there stock no longer selling, a sign of the cyclical nature of the business or did they recently get a bargain on an item?

Whilst the assets have increased a considerable amount, they are still roughly making up the same percentage of total assets, unfortunately the same can not be said of the increases in liabilities. Trade and other payables increased by 270% and current borrowings 530%, saying that another way, trade and other payables more than tripled whilst current borrowings increased by over 6 times. These are some really worrying increases, again

some of these increase can be attributed to the Turn Left acquisition, but the magnitude

of the increases is quite concerning. The result of all of this is a reduction

in tangible assets of 20% and due to the Turn Left acquisition being partially

paid for with shares, a reduction in Tangible assets per share of 28%.

Interestingly they are currently trading at roughly their tangible asset per

share price, $0.26.

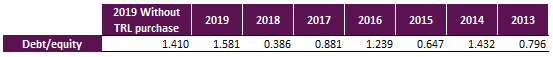

Along with the decrease in tangible assets the increase in

borrowings increases the debt to equity to 1.581, which is a lot higher than

their trailing 10 year average, excluding 2018, of ~1. I have included in the

table below the debt/equity if Cellnet hadn’t purchased Turn Left, it however

isn’t much better at 1.41, not unprecedented, by uncommon.

Evaluation

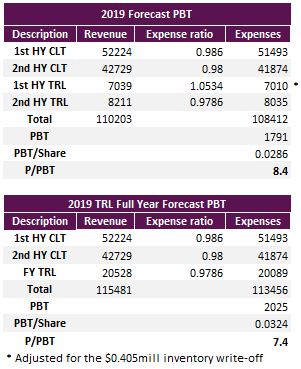

Below I have calculated my forecasted 2019 results both as

is and if they had owned Turn Left for the entire year. Assumptions are as

follows

- Over the past 8 years, Cellnet has generated, on average, 55% of their revenue in the first half of the year; Cellnet’s revenue for FY2019 is therefore predicted to $94.95mill.

- As Cellnet has stated that “Measures have been taken in December 2018 to mitigate” the low dollar, I have reduced the 2nd half’s expense ratio by .6% to 98% of revenue.

- Cellnet stated that had they owned Turn Left for the entire year, they would have generated $64.54mill in revenue and $1.11m in profit before tax, which equates to a profit margin for TRL of 1.72 (expense ratio of 98.28). Using this and assuming that TRL generates 65% of their revenue in the 1st half, gives TRL's 2HY revenue of $8.21mill and profit of $0.176mill.

- 1HY TRL expenses adjusted for the $0.405mill inventory write-off.

- No. Of shares outstanding 62,595,096

- Share price $0.245

The result of all of this is a Profit before tax per share

of 0.0286, which is slightly worse than 2017 and 2015, but falls quite below

2018 and 2016, see below. It also shows us that they are currently trading at a

price to profit before tax of 8.4, which is slightly below the trailing 8 year

P/PBT ratio average of 8.96 (excluding 2014 as it is an outlier).

The 2019 TRL full year forecast, keeping all things equal,

gives a good indication of the 2020 full year results. Which if correct and

assuming the P/PBT increases to the current level of 8.1, will see the share price increase by ~13.25%.

Discussion

The increase in the expense ratio by 3.7% has really hurt

Cellnet, added to this the untimely acquisition of Turn Left and you have the receipt for some disappointing results. The low profit margin of

both Turn Left and Cellnet gives a lot of opportunity for improvement,

especially when compared to their historical expense ratios.

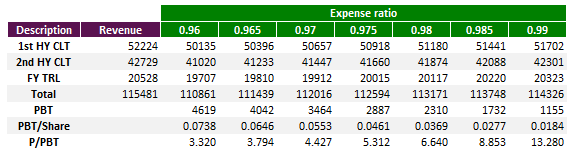

Cellnet has operated with the dollar at these low level (July 2015 to March 2016), however, today the global economy is in a much different position than it was then. Therefore unless the dollar rises back up in the near future the FY2016 expense ratio is not a comparative figure. I do believe that Cellnet will be able to reduce their expense ratio, just not as far as we have seen in recent years. To see the impact different expense ratio’s will have, I have tabulated, using FY2019 figures, the varying PBT for a range of expense ratios.

Cellnet has operated with the dollar at these low level (July 2015 to March 2016), however, today the global economy is in a much different position than it was then. Therefore unless the dollar rises back up in the near future the FY2016 expense ratio is not a comparative figure. I do believe that Cellnet will be able to reduce their expense ratio, just not as far as we have seen in recent years. To see the impact different expense ratio’s will have, I have tabulated, using FY2019 figures, the varying PBT for a range of expense ratios.

A reduction of the expense ratio to 97.5% or 98% (which is

still 1.61% and 2.11% above the trailing 4 year average) in 2020 and assuming

all other things being equal, has Cellnet currently trading at a 5 – 7 multiple.

These expense ratios are in my opinion achievable, Cellnet, since Alan Sparks

took over, have been continuously driving expenses down. The multiples are however not

amazing and certainly do not offer enough of a safety margin to rush out and buy.

However I believe that keeping everything equal, the company is currently

trading at roughly where it should be.

Keeping everything equal (or Ceteris

Paribus for the economists or Latin speakers out there) is an assumption that I

don’t believe is justified in today’s economy. The Australian dollar has been

predicted to fall further in the short term, a likely result of a range of possibilities, more specifically, China’s economy

slowing, a reduction in the demand for Australian resources (other than coal at

the moment due to the tragedy in Brazil, but this too will balance out), a

slowing of the world economy (due to a number of different reasons). All of these will further squeeze Cellnet's profit margin over the short

term. They have in recent times started to expand into other markets, helping to untether their profits to the Aussie economy, but I think this may be a

little too little too late.

Conclusion

Cellnet since Alan took over have reduced expenses, increased revenue, obtained strategic partners and increased their product mix, allowing them to enter a market that

is predicted to grow quite substantially. On the negative side, over the first half of 2019, they have

increased their debt to equity ratio to unprecedented levels and allowed

expenses to blow out. Cellnet is a good company, 2019 is in my opinion an unfortunate culmination of two unrelated events that have impacted Cellnet quite substantially, I see it as a hiccup more than a ongoing problem.

After doing my analysis I believe that Cellnet is

trading at roughly where they should be and therefore the loss has already been

made. As consumer spending is predicted to decrease and the dollar as well, I

believe that Cellnet will have a rough couple of years ahead but I see Cellnet as a long - term member of my portfolio. It, in my opinion, is therefore not

a time to buy nor is it a time to sell (if you have a long term perspective and

have no other better prospects), but a time to trust management and remember

that we purchased a portion of the company for the long term. I am writing this constantly wondering if I am being affected by conformation bias, if you feel I am, feel free to get in contact or leave a message below, I am always happy to hear from people who visit and read my blog.

During my initial analysis of Cellnet, I did not consider the impact the lowering of the dollar would have on Cellnet. Howard Marks says “You can’t predict. You can Prepare”. Whilst the lowering of the dollar may be unpredictable, it should be included in a pre-mortem, allowing an investor to require an adquate safety margin. I believe that the underlying thesis for Cellnet is still good, there most likely wasnt a large enough safety margin when publishing my initial thesis.

One last Howard Marks' quote that I believe sums up my mistake in my original analysis of Cellnet perfectly, "There’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future".

If you are interested in the retail industry, you can also read my opinion on Shaver Shop and The Reject Shop. I am on Twitter Follow @MaysTrav and Linkedin

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

The author is a current owner of a portion of Cellnet, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action