Insane in DE.membrane (ASX:DEM)

30/07/2019

Trav Mays

Today we will be looking at De.mem, a wastewater treatment

company that looks set to hit an inflection point. They have a proven and

patented technological advantage, which gives them the ability to not only

extract more clean water from wastewater, but they can do it whilst operating

at a lower cost. Technologies such as these are vital, according to an article

on National Geographic titled “Freshwater Crisis”, “Freshwater makes

up a very small fraction of all water on the planet. While nearly 70 percent of

the world is covered by water, only 2.5 percent of it is fresh. The rest is

saline and ocean-based. Even then, just 1 percent of our freshwater is easily

accessible, with much of it trapped in glaciers and snowfields. In essence,

only 0.007 percent of the planet's water is available to fuel and feed its 6.8

billion people”.Company

De.mem (ASX:DEM) is a water treatment company that generates

their revenue predominately through Build Own Operate (BOO) agreements, but

also through the sale of water treatment products (some of which they design

and build in-house) and general services. Whilst this has formed the backbone

of their revenue to date, the real growth potential comes from their worldwide

exclusive licence agreement with NTUitive (Nanyang Technological University),

which gives them access to cutting edge membrane technologies, Nanofiltraion,

Ultrafiltraion and Forward Osmosis. These membrane technologies are relatively

new (especially on the industrial level) and offer several advantages to

traditional technologies. These advantages essentially boil down to the system

producing very similar results, whilst requiring a lot less hydraulic pressure.

DEM was established in Singapore in 2013 and listed on the

ASX on the 7th April 2017, for $0.20 per share, giving them a market

cap of ~$19 million. Having just IPO’d, DEM moved quickly, setting up trials

for their membrane technology and the construction of a membrane manufacturing

facility. This facility was completed and operational by July 2017, producing

membrane modules in both 4 and 8 inch diameters. The perfect size for small

scale commercial projects, the size of projects they and the yet to be acquired

Akwa-Worx were undertaking.

Along with the massive boost to revenue, Akwa-Worx’s founder Mr. Shane Ayre came on board, bringing with him over 17 years of wastewater experience. Mr. Ayre founded Akwa-Worx in May 2002 and whilst it is quite common for the Director of an acquired company to stay on for a year or two as part of the sale agreement, I hope Mr. Ayre will be staying on a for a while longer. Mr. Ayre, along with the CEO, Mr. Andreas Kroell own a combined 4.5% of DEM, not huge but not small either. Positively Mr. Ayre has been adding to his holdings, having purchased 620,120 new shares in 2018.

Along with Mr. Ayre, DEM is being led by the talented Mr.

Andreas Kroell, who having working as a Director and Partner of one of DEM’s

largest shareholders, New Asia Investments for over 7 years, switched from being

an investor to a leader, taking on the role of CEO, in 2016. New Asia

Investments as described on Mr. Kroell’s LinkedIn page “is a Singapore-based

venture capital fund” “that co-invests with the National Research Foundation

(Singapore government) into companies from the water, clean-tech, industrial

and med tech sectors”. This experience would have clearly given him the

necessary skills to lead DEM into the future. Prior to this, he worked as a

Senior Portfolio Manager at Nanostart NG for just over 2.5 years and as a

Senior Auditor at Deloitte for just over a year.

Since Mr. Kroell and his team

purchased Akwa-Worx, it would appear that they have taken their eye off

Singapore somewhat. This can be seen (I might be reading too much in to this) when

we look at where geographically DEM generates their revenue from. Whilst both

the Singaporean Services and Sales of Goods segments were decreasing between

2017 and 2018 (95% and 60% respectively), all of the Australian segments were

improving, increasing from $7m in 2017 to $10m in 2018, a ~43% increase (2017

figure of $7m is the unaudited figure presented in the acquisition

announcement). The majority of this increase was in the contracting segment,

DEM obtained a total of $2.96m of new contracts in CY2018. Please note that

this graph is a bit misleading, the Australian 2017 figures are only for the 3

months after DE.mem purchased Akwa-Worx.

The focus on the Australian Leg has not stopped either, they recently opened 2 new offices, one in Melbourne and another in Adelaide and are still looking to recruit more people. DEM are currently advertising on their website for two new positions, a BDM in Melbourne and a Process Engineer in Caboolture. Whilst still only early days, it appears that the new offices and the continued focus on Australia is having a material effect on CY2019, having to date received $4.17m in new orders. That’s an increase of 40.9% when compare to the whole of 2018 and we are only in July, very impressive.

The increased focus on Akwa-Worx

is understandable, not only is there a large market to expand into, estimated

by IBIS to be worth $5b p.a., they are currently the only profitable segment of

the business, generating $0.37m profit before tax in CY2018, off $10.2m in

revenue (PBT margin of 3.1%). Not only that, but they keep getting better,

having increased revenue per month by 44% ($0.26m) and increased their return on

assets to 15% in CY2018.

“That’s all great Trav, but I need more up to date info, how have they

gone this year?” That’s a great question, unfortunately, we have only had

one quarterly statement released so far and they are yet to publish their half

year statement. But as you can see below, receipts from customers in the first

quarter are still quite high, not as high as in the past, but not looking too

bad.

A different story plays out once

we look a little bit further down the cash flow statement, it would appear that

whilst DEM was close to breaking even in Q2 and Q3 last year, they have fallen

away this quarter, both from a decrease in receipts and an increase in

expenses. Staff costs have increased, but that is expected, especially when you

open two more offices. One encouraging thing about the Q1 result was that

despite them decreasing the op costs as a percentage of receipts, they stated

“that the higher than average burn has been offset by receipt of a customer

payment of $715,000 on 8 April 2019, and as a result, “operating performance in

Q2 2019 is expected to be substantially improved”.

In other CY2019 encouraging news,

DEM just raised $1.9m by offering 13.6m shares at $0.14 each. A portion of this

is to continue the Akwa-Worx expansion, another portion is to keep the company

afloat and the rest is to fund acquisitions, which I originally thought was

going to be a German waste water treatment company (they have been speaking

about this for about a year) but a very recent announcement stated that they

are looking at a Tasmanian one instead, PumpTech. PumpTech specialises in the

design, supply, installation and maintenance of pump sets, pump stations and

sewage and water treatment plants; essentially, they do the exact the same

things as Akwa-Worx, just that they are situated in Tasmania. This acquisition,

if successful, (as of writing, they have only stated that negotiations are

currently being undertaken) would allow DEM to essentially bypass the cost and

time needed to set up a wing of Akwa-Worx in Tasmania, allowing them to simply

walk in, lean it out somewhat, implement their Australian wide systems, use

their economies of scale and increase profits (sounds simple, but as we all

know, is quite difficult).

Whilst they may have shifted a

large portion of their focus onto the Akwa-Worx business, this doesn’t mean

that they aren’t still concentrating on their licensed technology. Since the

Akwa-Worx acquisition, DEM has been busy validating and expanding the

technologies product range, below is a list of some of their achievements

- October 2017: Completed a number of pilot water treatment systems, giving them access to critical data

- November 2017: DEM signed a Memorandum of Understanding with Virtual Curtain China Limited to jointly pursue a number of Chinese opportunities, nothing has come of this as yet

- March 2018: Exclusively licenses hollow fiber forward osmosis membrane technology

- April 2018: The first order of the low pressure hollow fiber nanofiltration membrane modules, 20 8-inch modules in total, giving DEM a total revenue of A$30,000

- May 2018: Took a strategic stake (32%) in Aromatec, a Singaporean company targeting the food and beverage industry, at a cost of $100,000. Aromatec is focused on the commercialisation of an innovative hollow fiber forward osmosis technology

- May 2018: Introduced a Ultrafiltration membrane, expanding their product range considerably

- July 2018: Introduced a “point of use” filtration system using their nano and ultrafiltration technologies, targeting a worldwide market estimated to be worth US$24.5b by 2020

- October 2018: Recorded successes at the deployed pilot programs stated earlier. These sites were to treat wastewater at a car wash, an electronics factory and another to treat river water from the Mekong Delta.

- October 2018: Received AUD$90,000 from three small scale commercial projects using DEM’s filtration technologies, one at a car wash facility, another at an oil and gas factory and the last at a research institution, all in Singapore.

- November 2018: Released a ready for commercial sale Ultrafiltration membrane that was developed in-house.

- February 2019: Recorded their first sale (50 units) of domestic “point of use” water filters.

- June 2019: Recorded first revenues from commercialisation of new hollow fibre Forward Osmosis Technology, ~$150,000.

On the surface this last one

doesn’t sound like much and you are right, it is a small drop in 2018’s ~$10m

bucket. But it is however, as DEM stated, “validation for the commercial

readiness of the technology”, which has led to them “currently preparing an

industrial solution for this FO technology in response to strong customer

interest”. Which is great to hear, but as we have yet to see this technology

generate any real money, a better understanding of it and the other technologies

potential is needed before we even think about evaluating DEM.

Competitive Advantage

DEM’s competitive advantage comes

from their worldwide Exclusive Licence with NTUitive that gives them access to several

cutting-edge filtration technologies, each used at a different stage of the wastewater

filtration system. Their original licence gave them “details on the

fabrication, characteristics and performance related to the low pressure hollow

fibre nanofiltration membrane technology”. This license cost them $35,000 over

2 instalments, with DEM continuing to pay 3% of net sales of licensed products

and 25% of all sub licenses. So what does a low pressure hollow fibre

nanofiltration membrane do?

Traditionally the filtration of wastewater

has been completed through a process called reverse osmosis. Basically, reverse

osmosis, when used to treat wastewater, is the process of pushing unclean water

through a membrane, which filters out any particles that are of a certain size,

producing relatively clean water. The problem with this system is that it not

only removes the unwanted particles but all particles, which means needed elements

such as magnesium, calcium, potassium etc are often added back into the water

after it passes through this system. A relatively new process, called

nanofiltration is able to overcome this by operating at lower pressures, which

allows the use of more sophisticated membranes that are able to reject solutes

not only on size but on charge as well. By doing this, they have created

membranes that can reject just the unwanted elements whilst operating at a

lower cost.

Nanofiltration up until recently,

was mainly used to treat portable drinking water, its usefulness was however

expanded when DEM in conjunction with Nanyang Technological University produced

the first industrial sized low-pressure hollow fibre nanofiltration membrane

module. Their nanofiltration membrane can produce almost as good results (when

compared to reverse osmosis), whilst requiring only 20% of the hydraulic

pressure, 2 bars of pressure as opposed to the 10-15 bars typically needed in

the reverse osmosis process. To put that into context, 2 bars of pressure is

equal to 29 PSI, just shy of what you put in your car tyre (32psi) whilst 10

bars of pressure converts to 145 PSI, 4.5 x your tyre pressure. As you can

imagine, the large reduction in the pressure required, results in a decrease in

the initial CAPEX, (Capital Expenditure; the pump size and in some cases, pump

type required are smaller/cheaper), but not only that, these types of systems

also have a large impact on OPEX (Operating Expenditure), in some cases

reducing the energy required by as much as 80%. This cost saving is extremely

important, as the US

Department of Energy’s Office of Industrial Technology highlight in

their document titled “PumpLife Cycle Costs”, “Energy consumption is often one of the larger cost

elements and may dominate the LCC (Life Cycle Cost analysis), especially if

pumps run more than 2000 hours per year”. Whilst obviously helping to save

newly created plants a large sum of money, due to the standard size of the

modules, DEM’s nanofiltration modules can, at times, simply replace existing

reverse osmosis modules without the need to change the system in anyway, other

than reducing the pressure at the pump. The estimated market size for this

technology is ~$570 million p.a.

Along with their nanofiltration

modules, DEM has added a number of other technologies to its product list, most

notably an Ultrafiltration membrane, which was developed in house and therefore

“comes without any royalty obligations” and a domestic water “point of use”

filter system. The Ultrafiltration membrane is used in the pre-filtration step

for both reverse osmosis and nanofiltration systems, where it removes bacteria

and viruses. It has an estimated market size of ~$570 million p.a., whilst the

point of use filters market size is estimated to be ~$19.9 billion worldwide,

be it an industry with far more competition.

The other exciting technology that DEM has at their disposal is the hollow fibre forward osmosis membrane. As opposed to reverse osmosis that uses hydraulic pressure to push the fluid through the membrane, forward osmosis uses an osmotic pressure differential to draw the fluid through the membrane. For those of you who may not be familiar with this phenomenon, this video gives a great explanation, but essentially it works by two fluids with differing solute levels equalising. For example, if you have a u – tube that has a membrane with pore sizes large enough for just water (Solvent) to flow through, if you were to dissolve salt (Solute) in one side, this would decrease the water concentration on that side whilst simultaneously increasing the solute concentration. As the universe likes to always be in equilibrium, the water molecules will be drawn to the side with a relatively high concentration of solute, this will result in the water level on that side being higher than the lower solute concentration side.

Forward osmosis takes advantage of this phenomenon by using a draw fluid (relatively high solute fluid) to draw the unclean water through a membrane. To do this, unclean water is pumped passed a membrane with a draw fluid being pumped passed the other side. The high solute concentration therefore draws the unclean fluid through the membrane and into the draw fluid, cleaning it in the process. This clean water is than separated from the draw fluid, with the draw fluid again being pumped past the membrane, which in turn pulls clean water through the membrane and on and on it goes.

The advantage of forward osmosis technology

is that it can reduce the amount of concentrated liquid that is needed to be

treated at a dedicated water treatment plant. Onsite water treatment technology

is currently only able to economically extract a percentage of the potential

clean water, the rest is trucked to a dedicated water treatment plant at a cost

of ~$400/tonne, where they treat it before putting it back into the environment.

DEM’s forward osmosis system is able to reduce the volume of the rejected

concentrated liquid by as much as two thirds, giving consumers a considerable

cost saving. Even more impressive, is the fact that this “technology can be

utilised in place of current ‘Zero Liquid Discharge’ processes and evaporators,

which are expensive to purchase and operate, leaving De.mem well positioned to

capitalise on the market, which is cited to be worth approximately A$400

million per annum (Source: ForwardOsmosis Tech)”.

Evaluation

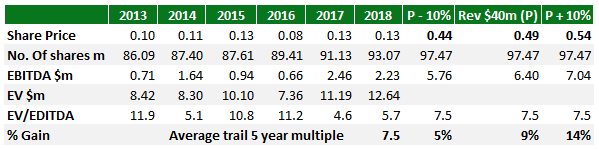

To Evaluate DEM, due to them not currently generating a profit and the insane level of difficulty in predict anything (earnings in this case), I will simply compare DEM’s Price/Receipts from Customers to a number of companies in a similar albeit different industries.

If we use CY2018’s price to cash receipts, we can see that DEM is trading at a multiple less than half of the next closest.

From this we can calculate what the share price and potential gains we will receive if the market was to assign a more aligned price/cash ratio, the results from which are quite encouraging. If the market assigns just a price/cash ratio of 3, we will see a gain of roughly 30%, keep in mind that that is still only just over half of the next lowest.

‘That’s all well and great Trav, but Q1 saw some massive changes to cash received, especially from PET who received more cash in Q1 2019 than in all of CY2018 and DEM’s decreased by half a mill’. That’s a good point, so to double check our analysis we will run it again using 2019 Q1 figures. As you can see, the results are reassuringly similar.

Risks

This is again my attempt at evaluating a growth company. I therefore would like to take a minute to explain the huge amount of risks associated with this company. I outlined a number of generic risks in my recent article on Tubi (ASX:2BE) so I won’t repeat them here, but that doesn’t mean DEM doesn’t come with its own set of specific risks, some of which I will outline below.

The large potential gain that could come from their licensed technology, whilst it is patented, it isn’t patent around the whole world. Not only that, but the patent only describes a certain type of manufacturing process, this means that other people could potentially produce the membranes using other means, or simply use the same technology in a country where they don’t have patent protection.

This means that they are essentially reliant on the first movers’ advantage, which while it may be extremely powerful, it only gives you a short window in which to prove your product and build brand loyalty. Amazon used this wonderfully to their advantage, everyone knows the brand and they have made their product extremely sticky. Netflix on the other hand is an example of a company that hasn’t used it as well. Their product isn’t especially sticky, I got rid of my subscription ages ago and with a large portion of their good content going to Disney Plus, I think they might be in a bit of trouble in the not too distant future, especially if their recent subscription numbers are anything to go by. Management will need to act quickly and execute well over the coming years for us to receive the payoff that I believe can be generated.

My above analysis is extremely flimsy.

It is currently trading at a 35.7% premium to the price offered to institutional investors just last month.

I learnt a little about process engineering when I completed Mechanical Engineering and a bit more when I did Petroleum Engineering, but I am definitely not a subject matter expert, so my thoughts on the usefulness of this technology could be incorrect.

Whilst not being an ethical investor by any stretch of the meaning, I do however, find myself drawn to companies that are having a positive effect on the environment (who really wants to be part owner of a cigarette company?), which has lead me to purchasing companies when I don’t fully understand them or overlook certain aspects. Windlab is a good example of that, whilst I understand the technology and thinks it’s amazing, I don’t really understand their business model, but I purchased anyway (I have since realised this and sold). Another example is Carnegie Clean Energy, despite some questionable management decisions I purchased a small bundle because again I really liked their technology, I did sell before the price got anywhere near where it is now, but my judgement was clouded due to the ethical bias that I have. This could be the same story playing out again, as Mark Twain is rumoured to have said “History doesn’t repeat itself, but it often rhymes”.

The large potential gain that could come from their licensed technology, whilst it is patented, it isn’t patent around the whole world. Not only that, but the patent only describes a certain type of manufacturing process, this means that other people could potentially produce the membranes using other means, or simply use the same technology in a country where they don’t have patent protection.

This means that they are essentially reliant on the first movers’ advantage, which while it may be extremely powerful, it only gives you a short window in which to prove your product and build brand loyalty. Amazon used this wonderfully to their advantage, everyone knows the brand and they have made their product extremely sticky. Netflix on the other hand is an example of a company that hasn’t used it as well. Their product isn’t especially sticky, I got rid of my subscription ages ago and with a large portion of their good content going to Disney Plus, I think they might be in a bit of trouble in the not too distant future, especially if their recent subscription numbers are anything to go by. Management will need to act quickly and execute well over the coming years for us to receive the payoff that I believe can be generated.

My above analysis is extremely flimsy.

It is currently trading at a 35.7% premium to the price offered to institutional investors just last month.

I learnt a little about process engineering when I completed Mechanical Engineering and a bit more when I did Petroleum Engineering, but I am definitely not a subject matter expert, so my thoughts on the usefulness of this technology could be incorrect.

Whilst not being an ethical investor by any stretch of the meaning, I do however, find myself drawn to companies that are having a positive effect on the environment (who really wants to be part owner of a cigarette company?), which has lead me to purchasing companies when I don’t fully understand them or overlook certain aspects. Windlab is a good example of that, whilst I understand the technology and thinks it’s amazing, I don’t really understand their business model, but I purchased anyway (I have since realised this and sold). Another example is Carnegie Clean Energy, despite some questionable management decisions I purchased a small bundle because again I really liked their technology, I did sell before the price got anywhere near where it is now, but my judgement was clouded due to the ethical bias that I have. This could be the same story playing out again, as Mark Twain is rumoured to have said “History doesn’t repeat itself, but it often rhymes”.

Discussion

This filtration system has not only been proven in the laboratory, but in real world applications as well. This is very important milestone for DEM and one that they have only completed relatively recently (October 2018). Along with these pilot projects, DEM has secured a number of orders for both their Nanofilters, Ultrafilters and point of use filters, which is excellent to see. The momentum is something that DEM will need to continue to build on, which leads me to their Australian Acquisitions.

The Australian Acquisitions (one is still currently pending) not only gives DEM an opportunity to generate revenue in the short term, but also gives them the chance to get more of their product out working in the market and therefore more projects to promote and continue the momentum. I see these acquisitions as DEM converting themselves into a company similar to LaserBond, whereby they both have intellectual property that will form the backbone of their growth, but in the mean time operate businesses that are sort of a supporting act, generating a profit, but have limited growth potential. LaserBond’s revenue was stagnant for a number of years following the GFC, it wasn’t until 2 years after they had started to invest in their R&D again, that their revenue started to build, resulting in the large increase in its market cap that we saw in 2018 (If you would like to learn more about LaserBond, please check out my article here). DEM has already spent the money on purchasing and developing their range, they have shown its usefulness both in the lab and out in the real world, so I believe that DEM is similar to LaserBond around the 2017 mark, before the inflection point, but by how much, who knows.

Within the LaserBond article I used the 6 common ingredients of 100 Baggers from Mr. Christopher Mayer’s book “100 Baggers: Stocks that return 100 to 1 and how to find them” in an effort to learn more about inflection point investing. LaserBond around the 2017 mark had five of the six ingredients needed, with the final one just being time for a company to compound its good work. DEM only has 4 of the ingredients, not quite as good as LaserBond, but still quite reassuring. They are as follows:

1. They are small

2. Have a low multiple

3. Owner operators

4. They have been investing in themselves

The additional ingredient that LaserBond had was high returns on capital, which is quite an important one, but something I believe DEM will be able to generate in the future. I’m not trying to say that DEM will be the next LaserBond, I am just highlighting that they both share characteristics with companies that have gone on to become 100 Baggers. LaserBond had several things going for it that DEM doesn’t have, such as the fact that they developed their technology inhouse and were profitable at the time. I view DEM similar to the way I view XRF Scientific, both are currently valued at a 30 – 40% discount from what I believe they are worth and both have a large potential upside, assuming they get some lucky breaks and management executes well.

The Australian Acquisitions (one is still currently pending) not only gives DEM an opportunity to generate revenue in the short term, but also gives them the chance to get more of their product out working in the market and therefore more projects to promote and continue the momentum. I see these acquisitions as DEM converting themselves into a company similar to LaserBond, whereby they both have intellectual property that will form the backbone of their growth, but in the mean time operate businesses that are sort of a supporting act, generating a profit, but have limited growth potential. LaserBond’s revenue was stagnant for a number of years following the GFC, it wasn’t until 2 years after they had started to invest in their R&D again, that their revenue started to build, resulting in the large increase in its market cap that we saw in 2018 (If you would like to learn more about LaserBond, please check out my article here). DEM has already spent the money on purchasing and developing their range, they have shown its usefulness both in the lab and out in the real world, so I believe that DEM is similar to LaserBond around the 2017 mark, before the inflection point, but by how much, who knows.

Within the LaserBond article I used the 6 common ingredients of 100 Baggers from Mr. Christopher Mayer’s book “100 Baggers: Stocks that return 100 to 1 and how to find them” in an effort to learn more about inflection point investing. LaserBond around the 2017 mark had five of the six ingredients needed, with the final one just being time for a company to compound its good work. DEM only has 4 of the ingredients, not quite as good as LaserBond, but still quite reassuring. They are as follows:

1. They are small

2. Have a low multiple

3. Owner operators

4. They have been investing in themselves

The additional ingredient that LaserBond had was high returns on capital, which is quite an important one, but something I believe DEM will be able to generate in the future. I’m not trying to say that DEM will be the next LaserBond, I am just highlighting that they both share characteristics with companies that have gone on to become 100 Baggers. LaserBond had several things going for it that DEM doesn’t have, such as the fact that they developed their technology inhouse and were profitable at the time. I view DEM similar to the way I view XRF Scientific, both are currently valued at a 30 – 40% discount from what I believe they are worth and both have a large potential upside, assuming they get some lucky breaks and management executes well.

Conclusion

If you have been reading some of my posts over the past couple of months, you would have noticed that I am currently trying to better predict companies at or just before they reach an inflection point, DEM is in my opinion, just such a company. The market is assigning a market cap of just $25m, which is only 6 million higher than when they IPO’d back in 2017. Since then they have proven and increased their product offering, increased their revenue by 3657%, purchased a 32% stake in Aromatec, expanded into Australia through an acquisition (potentially again) and then further expanded within Australia by opening offices in Adelaide and Melbourne. The Australian revenue since DEM has taken over have increased by $3m (42.8%) and their new contracts to date (July) are 40.2% higher than the whole of CY2018. Whilst they have not yet produced a profit in any quarter, they got extremely close in Q2 and Q3 last year and I believe they are currently sitting just a stone’s throw away from hitting this massive milestone. However, due to this, I would recommend that only those with a considerable risk tolerance begin their own analysis, a lot of things need to come together for this thesis to work out.

As always, thanks a lot for reading, I really appreciate all the feedback I have received so far. I have also just recently found twitter Follow @MaysTrav, give me a follow if you like and/or send me a msg, it’s always great to meet other ASX investors. If you don't have twitter we can connect on Linkedin  .

.

.

.

Sources:

- https://www1.eere.energy.gov/manufacturing/tech_assistance/pdfs/pumplcc_1001.pdf

- https://www.nationalgeographic.com/environment/freshwater/freshwater-crisis/

- Jiao, Yanmei & Kang, Yuejun & Yang, Chun. (2015). Osmosis and Its Applications.

- http://regularbio.blogspot.com/2018/11/diffusion-and-osmosis.html

- https://www.youtube.com/watch?v=L-osEc07vMs

- https://www1.eere.energy.gov/manufacturing/tech_assistance/pdfs/pumplcc_1001.pdf

The author is a current owner of a portion of DE.mem, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action. Please refer to Disclaimer page for a full list of disclaimers.