Winds of change at Windlab (ASX:WND)

15/11/2018

Trav Mays

Follow @MaysTrav

Description

Windlab (ASX:WND), formed in

2003, is an international renewable energy development company, with projects

in Australia, Kenya, South Africa, Tanzania and USA. The company is involved in

wind generation projects from development through to operating.

Windlab is currently

transitioning into a more revenue sustainable model, whereby they retain a % of

the project after the development stage allowing them to collect a reoccurring

dividend. Traditionally they have sold the project at or near financial close

generating a 5 – 10x return; the expected return from continuing on with a % of

the project is an IRR between 8 – 15%.

Dr Nathan Steggal and Dr Keith

Ayotte, currently employed as General Operations Manager and Chief Scientist

respectively, whilst working for CSIRO developed Windscape, Windlab’s premier

wind mapping technology.

Company

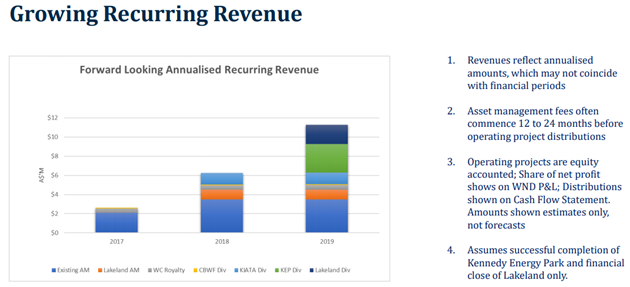

Windlab has to date, successfully

completed 9 projects with a combined total of 1093MW of renewable power

capacity, with their transition to a more stable revenue model mostly going to

plan. The graph below shows their increase in recurring revenue, assuming that

the Kennedy Energy Park and financial close of Lakeland will be completed

within 2018, this however is no longer the case. InfraRed, who had previously

signed a non binding term sheet to provide 100% of the equity for the

construction of Lakeland has since pulled out, “citing its inability to price

risk associated with the project’s grid connection, including risk of network

losses and risk of curtailment.” These are very real risks, especially in the

remote areas where the network connections are “weak” and therefore are unable

to withstand the large fluctuations of power from renewables. To limit the

effects on the connection, the Australian Energy Market Operator (AEMO) can

require additional equipment be installed to strengthen the grid, however even

with this, AEMO has the ability to curtail the amount of energy entering the

network from a project. Windlab states that “With high quality wind resources

and full development approvals, Windlab remains confident in the Lakeland

project and will continue to work towards financial close of Lakeland as

quickly as possible. However, given this unexpected development, it is likely

that financial close of the project will be delayed into early 2019.”

Source: Windlab

Results Presentation

Windlab co owns (50% Windlab, 50%

Eurus Energy) Kennedy Energy Park, which is Australia’s first Wind, Solar and

storage renewable energy facility to be constructed on Australia’s National

Energy Network. The $160M project began construction in December 2017 and is

forecast to have construction and commissioning completed in the early part of

the last quarter 2018.

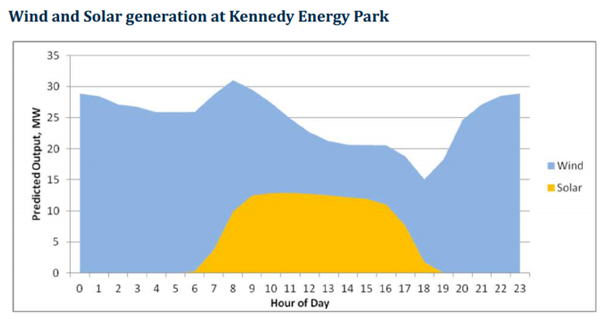

Windlab is using the Kennedy

Energy Park to demonstrate that wind power is not in direct competition with

solar, but complements it. This is clearly seen on the graph below, which shows

that wind generation reduces when solar is most productive and increases when

it is less productive, at the Kennedy Energy Park, except for in the early

morning. The combination of the two allows for a more even distribution,

reducing curtailment and network effects.

Source: Windlab

Results Presentation

Along with this, Windlab was recently

been awarded approval for the first wind farm within Tanzania, for up to 300MW

of capacity. They have also successfully secured an Energy and Environment

Partnership grant from the Ministry of Affairs of Finland to help fund this

project. The first phase of the project will be able to power nearly 1 million

average Tanzanian homes.

Management

Windlab has a diverse and

experienced management team. Roger Price, board member since 2007 and CEO since

2011, has over 30 years experience working within technological companies, most

notably the CEO of Reino International. Reino is an Australian start up

providing technically advanced parking solutions. Roger led an aggressive

growth strategy, growing Reino from 30 staff to over 300 within 2 years whilst

overseeing 4 acquisitions. Along with his current position he is also a General

Partner of Innovation Capital an early stage venture capital fund, investing in

Australian technology companies (Innovation capital is the current largest

shareholder of Windlab, with 18.71% of shares). Roger owns 1.95% or $1.5mill (@$1.1/share)

of Windlab.

Complimenting Roger’s leadership

skills is Joseph O’Brien, an Independent non - executive board member, who

brings nearly 20 years of consulting and project development experience within

the electricity supply industry. He has worked with in both the electrical

infrastructure and trading markets, bringing a more holistic understand of the market

to Windlab. Roger owns .54% or $0.19mill (@$1.1/share) of Windlab.

Pippa Downs as a Non Executive

Director since July 2017, brings over 25 years of international banking and

finance experience. Charles Macek has over 15 years of board experience and

John Cooper who has over 10 years of experience on boards in both executive and

non-executive roles in the engineering, mining, property and construction

industries. They own .2%, .3% & .25% respectively.

The Board combines together

extremely experienced people with diverse backgrounds and a set of skills that

compliments one another perfectly. Along with their experience, they are

reputable people, a number of which are members of different charity boards.

Competitive advantage

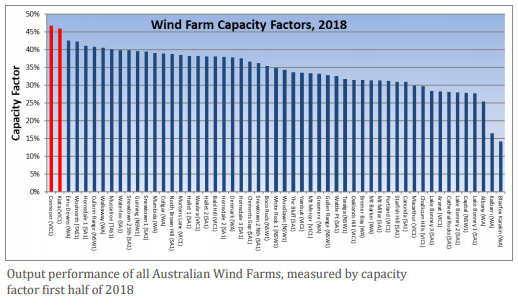

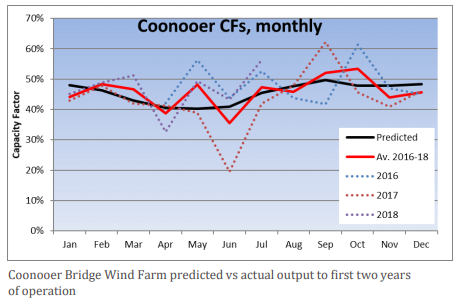

Windlab’s competitive advantage

is its Windscape technology, which is able to map and pinpoint high wind

resource sites. The advantages of which can be seen in the next 2 graphs. They

have the 2 highest sites measured by capacity in Australia with the predicted

vs actual graph, showing the accuracy of the software.

Source: Windlab

Results Presentation

Macro Overview

The renewable energy sector has

had very favorable tailwinds over the last 10 years. Australia continues on

the longest Bull Run in history, complementing this is ageing coal fired power

stations, the Paris agreement and a global move towards renewable energies. The

result of which was the Renewable Energy Target, an Australian Government

mandated target of 33000 GWh or at least 20% of electricity being produced by

renewables by 2020.

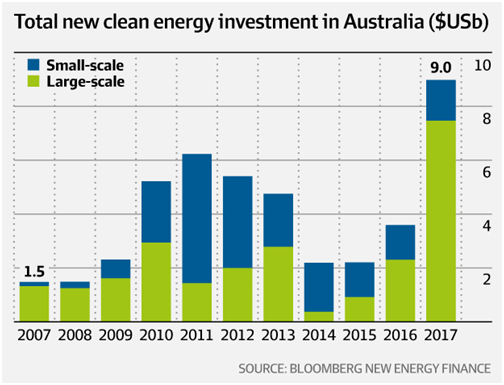

Due to a large increase in investment

in 2017, Australia is on track to meet the Renewable energy target, with

Bloomberg New Energy Finance predicting a slowdown in investment with a

collapse post 2020.

Following on from the Renewable

Energy Target, a National Energy Guarantee has been proposed, however this so

far has had little support and there doesn’t appear to be growing bipartisan

support for this or any other scheme. It has been forecast that without a government

mandated renewable energy target that the investment in renewable energies will

dry up, however the International Renewable Energy Agency has predicted a 21%

reduction in the cost of onshore wind by 2019, bring the levelised cost of

energy (LCOE) down to $30/MWh, the cost of coal from a producing plant is

currently $40/MWh, making it not only cheaper than new coal but existing coal.

While there is a very low chance

that a renewable energy policy will be decided on the national level in the

short term, states have declared their own renewable energy targets. Queensland

has a goal of 50% of power to be generated from renewable energies, which will

require between 4000 – 5500MW’s of new renewable projects being completed

before 2030, along with this, they have a goal of having net zero emissions by

2050.

This is of exceptional importance to Windlab, as the next graph

shows, an increase in Queensland’s mix of renewable power to include just over

50% wind power, will eliminate the need for any further storage and still keep

curtailment below 10%.

Source: Windlab

Results Presentation

Along with Queensland, a number

of other states have self imposed renewable energy targets. NT also has a 50%

renewable energy target by 2030, Vic 25% by 2020 and 40% by 2025, SA 50% by

2025, Tas 100% by 2022 and ACT 100% by 2020. Along with these targets QLD, VIC,

NSW, TAS, ACT and SA have a goal of having net zero emissions by 2050. These

goals will need a combination of renewable energies to be achieved. Below is

Bloomberg’s forecast renewable energy mix, if correct, onshore wind will make

up a large percentage of Australian Electricity.

Source: Windlab Results Presentation

Competition

Infigen Energy is Windlab’s main

Australian competition, however given the business model of Windlab, I believe

that they are more comparable with a development and construction company. With

this in mind, below is the ranking of Windlab and Infigen FY2017 figures. As

you can see, Windlab has better figures for EBITDA/EV, P/S, EV/S, P/TB, P/E, EV

Multiple and Z score (7 of the 9).

Using a conservative multiple of

50% of IFN’s 2017 EV multiple on WND’s last year figures gives a share price of

$2.99.

Catalyst

The pulling out of InfraRed on

the Lakeland project has resulted in Windlab having a negative return for

FY2018. This has resulted in a large decrease in the share price from a high of

$1.68 to $1.1 in four months.

However given the talent and

experience of the management team, this coupled with their experience with weak

connections in outback Queensland, has resulted in an excellent buying

opportunity. They are well positioned to take advantage of the Queensland government’s

renewable energy target and have diversified their country risk by having an

international focus.

They have a strong balance sheet

with $8.3mill in cash and only $2.9mill in borrowings. In the worst case

scenario, assuming they keep their expenses and reoccurring revenue the same

and have no additional projects, it would take 2.65 years for them to run out of

cash.

Reason to not invest

The connection and curtailment

risks associated with the outback Queensland projects these combined with the

potential slowdown in renewable investment within Australia are very concerning

and real risks. Windlab, may be unsuccessful in finding another firm to supply

equity for the construction of Lakeland, resulting in a large loss of resources

and future revenue. While they have reduced their country risks, they have

subsequently increased their foreign exchange risk as well as increased their

political risk by targeting countries with less stable governments than

Australia.

Recommendation

Windlab is an example of an

excellent value company. A strong balance sheet, excellent staff and with a proven

technological advantage, Windscape. The recent removal of finances from

InfraRed and an uncommon business model has resulted, in my opinion, in a very

undervalued business.

Whilst on a Federal level there

may be no renewable energy target in the near future, to meet the state

renewable energy targets, a large amount of investment is going to be needed.

With the advantages of combining solar with wind (where wind is available) a

large percentage of investment will need to be put into wind infrastructure.

Windlab’s ability to pick high wind resources sites coupled with their

demonstrated ability to see projects through from the initial stage to

operation, puts Windlab in an excellent position to take advantage of the

situation. I believe that Windlab will be an excellent long term investment.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion of Windlab, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action

Follow @MaysTrav

Description

Windlab (ASX:WND), formed in

2003, is an international renewable energy development company, with projects

in Australia, Kenya, South Africa, Tanzania and USA. The company is involved in

wind generation projects from development through to operating.

Windlab is currently

transitioning into a more revenue sustainable model, whereby they retain a % of

the project after the development stage allowing them to collect a reoccurring

dividend. Traditionally they have sold the project at or near financial close

generating a 5 – 10x return; the expected return from continuing on with a % of

the project is an IRR between 8 – 15%.

Dr Nathan Steggal and Dr Keith

Ayotte, currently employed as General Operations Manager and Chief Scientist

respectively, whilst working for CSIRO developed Windscape, Windlab’s premier

wind mapping technology.

Company

Windlab has to date, successfully

completed 9 projects with a combined total of 1093MW of renewable power

capacity, with their transition to a more stable revenue model mostly going to

plan. The graph below shows their increase in recurring revenue, assuming that

the Kennedy Energy Park and financial close of Lakeland will be completed

within 2018, this however is no longer the case. InfraRed, who had previously

signed a non binding term sheet to provide 100% of the equity for the

construction of Lakeland has since pulled out, “citing its inability to price

risk associated with the project’s grid connection, including risk of network

losses and risk of curtailment.” These are very real risks, especially in the

remote areas where the network connections are “weak” and therefore are unable

to withstand the large fluctuations of power from renewables. To limit the

effects on the connection, the Australian Energy Market Operator (AEMO) can

require additional equipment be installed to strengthen the grid, however even

with this, AEMO has the ability to curtail the amount of energy entering the

network from a project. Windlab states that “With high quality wind resources

and full development approvals, Windlab remains confident in the Lakeland

project and will continue to work towards financial close of Lakeland as

quickly as possible. However, given this unexpected development, it is likely

that financial close of the project will be delayed into early 2019.”

Source: Windlab

Results Presentation

Windlab co owns (50% Windlab, 50%

Eurus Energy) Kennedy Energy Park, which is Australia’s first Wind, Solar and

storage renewable energy facility to be constructed on Australia’s National

Energy Network. The $160M project began construction in December 2017 and is

forecast to have construction and commissioning completed in the early part of

the last quarter 2018.

Windlab is using the Kennedy

Energy Park to demonstrate that wind power is not in direct competition with

solar, but complements it. This is clearly seen on the graph below, which shows

that wind generation reduces when solar is most productive and increases when

it is less productive, at the Kennedy Energy Park, except for in the early

morning. The combination of the two allows for a more even distribution,

reducing curtailment and network effects.

Source: Windlab

Results Presentation

Along with this, Windlab was recently

been awarded approval for the first wind farm within Tanzania, for up to 300MW

of capacity. They have also successfully secured an Energy and Environment

Partnership grant from the Ministry of Affairs of Finland to help fund this

project. The first phase of the project will be able to power nearly 1 million

average Tanzanian homes.

Management

Windlab has a diverse and

experienced management team. Roger Price, board member since 2007 and CEO since

2011, has over 30 years experience working within technological companies, most

notably the CEO of Reino International. Reino is an Australian start up

providing technically advanced parking solutions. Roger led an aggressive

growth strategy, growing Reino from 30 staff to over 300 within 2 years whilst

overseeing 4 acquisitions. Along with his current position he is also a General

Partner of Innovation Capital an early stage venture capital fund, investing in

Australian technology companies (Innovation capital is the current largest

shareholder of Windlab, with 18.71% of shares). Roger owns 1.95% or $1.5mill (@$1.1/share)

of Windlab.

Complimenting Roger’s leadership

skills is Joseph O’Brien, an Independent non - executive board member, who

brings nearly 20 years of consulting and project development experience within

the electricity supply industry. He has worked with in both the electrical

infrastructure and trading markets, bringing a more holistic understand of the market

to Windlab. Roger owns .54% or $0.19mill (@$1.1/share) of Windlab.

Pippa Downs as a Non Executive

Director since July 2017, brings over 25 years of international banking and

finance experience. Charles Macek has over 15 years of board experience and

John Cooper who has over 10 years of experience on boards in both executive and

non-executive roles in the engineering, mining, property and construction

industries. They own .2%, .3% & .25% respectively.

The Board combines together

extremely experienced people with diverse backgrounds and a set of skills that

compliments one another perfectly. Along with their experience, they are

reputable people, a number of which are members of different charity boards.

Competitive advantage

Windlab’s competitive advantage

is its Windscape technology, which is able to map and pinpoint high wind

resource sites. The advantages of which can be seen in the next 2 graphs. They

have the 2 highest sites measured by capacity in Australia with the predicted

vs actual graph, showing the accuracy of the software.

Source: Windlab

Results Presentation

Macro Overview

The renewable energy sector has

had very favorable tailwinds over the last 10 years. Australia continues on

the longest Bull Run in history, complementing this is ageing coal fired power

stations, the Paris agreement and a global move towards renewable energies. The

result of which was the Renewable Energy Target, an Australian Government

mandated target of 33000 GWh or at least 20% of electricity being produced by

renewables by 2020.

Due to a large increase in investment

in 2017, Australia is on track to meet the Renewable energy target, with

Bloomberg New Energy Finance predicting a slowdown in investment with a

collapse post 2020.

Following on from the Renewable

Energy Target, a National Energy Guarantee has been proposed, however this so

far has had little support and there doesn’t appear to be growing bipartisan

support for this or any other scheme. It has been forecast that without a government

mandated renewable energy target that the investment in renewable energies will

dry up, however the International Renewable Energy Agency has predicted a 21%

reduction in the cost of onshore wind by 2019, bring the levelised cost of

energy (LCOE) down to $30/MWh, the cost of coal from a producing plant is

currently $40/MWh, making it not only cheaper than new coal but existing coal.

While there is a very low chance

that a renewable energy policy will be decided on the national level in the

short term, states have declared their own renewable energy targets. Queensland

has a goal of 50% of power to be generated from renewable energies, which will

require between 4000 – 5500MW’s of new renewable projects being completed

before 2030, along with this, they have a goal of having net zero emissions by

2050.

This is of exceptional importance to Windlab, as the next graph

shows, an increase in Queensland’s mix of renewable power to include just over

50% wind power, will eliminate the need for any further storage and still keep

curtailment below 10%.

Source: Windlab

Results Presentation

Along with Queensland, a number

of other states have self imposed renewable energy targets. NT also has a 50%

renewable energy target by 2030, Vic 25% by 2020 and 40% by 2025, SA 50% by

2025, Tas 100% by 2022 and ACT 100% by 2020. Along with these targets QLD, VIC,

NSW, TAS, ACT and SA have a goal of having net zero emissions by 2050. These

goals will need a combination of renewable energies to be achieved. Below is

Bloomberg’s forecast renewable energy mix, if correct, onshore wind will make

up a large percentage of Australian Electricity.

|

| Source: Windlab Results Presentation |

Competition

Infigen Energy is Windlab’s main

Australian competition, however given the business model of Windlab, I believe

that they are more comparable with a development and construction company. With

this in mind, below is the ranking of Windlab and Infigen FY2017 figures. As

you can see, Windlab has better figures for EBITDA/EV, P/S, EV/S, P/TB, P/E, EV

Multiple and Z score (7 of the 9).

Using a conservative multiple of

50% of IFN’s 2017 EV multiple on WND’s last year figures gives a share price of

$2.99.

Catalyst

The pulling out of InfraRed on

the Lakeland project has resulted in Windlab having a negative return for

FY2018. This has resulted in a large decrease in the share price from a high of

$1.68 to $1.1 in four months.

However given the talent and

experience of the management team, this coupled with their experience with weak

connections in outback Queensland, has resulted in an excellent buying

opportunity. They are well positioned to take advantage of the Queensland government’s

renewable energy target and have diversified their country risk by having an

international focus.

They have a strong balance sheet

with $8.3mill in cash and only $2.9mill in borrowings. In the worst case

scenario, assuming they keep their expenses and reoccurring revenue the same

and have no additional projects, it would take 2.65 years for them to run out of

cash.

Reason to not invest

The connection and curtailment

risks associated with the outback Queensland projects these combined with the

potential slowdown in renewable investment within Australia are very concerning

and real risks. Windlab, may be unsuccessful in finding another firm to supply

equity for the construction of Lakeland, resulting in a large loss of resources

and future revenue. While they have reduced their country risks, they have

subsequently increased their foreign exchange risk as well as increased their

political risk by targeting countries with less stable governments than

Australia.

Recommendation

Windlab is an example of an

excellent value company. A strong balance sheet, excellent staff and with a proven

technological advantage, Windscape. The recent removal of finances from

InfraRed and an uncommon business model has resulted, in my opinion, in a very

undervalued business.

Whilst on a Federal level there

may be no renewable energy target in the near future, to meet the state

renewable energy targets, a large amount of investment is going to be needed.

With the advantages of combining solar with wind (where wind is available) a

large percentage of investment will need to be put into wind infrastructure.

Windlab’s ability to pick high wind resources sites coupled with their

demonstrated ability to see projects through from the initial stage to

operation, puts Windlab in an excellent position to take advantage of the

situation. I believe that Windlab will be an excellent long term investment.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion of Windlab, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action