Soldiering on, Shaver Shop half year results (ASX:SSG)

Trav Mays

Follow @MaysTrav

Today we will be diving into Shaver Shop’s 2019 half year results, some good, some not so good, but if you’ve read my initial thesis, the results are as you’d expect, fairly average.

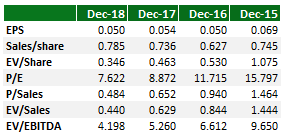

On a historical 7 year Enterprise

multiple, shaver shop appears to have ~19.8% upside potential, which when added

to the ~10% dividend yield, is a pretty healthy return.

As I believe Shaver Shop has

become a dividend stock, with little chance of future growth, I have also

included the Gordon Growth Model in this evaluation. For those unfamiliar with

the Gordon Growth Model, it is a simple formula for evaluating the price of a

stock using its dividend and the potential shareholders required return. It

does however have a number of large limitations, it assumes the growth rate goes

on forever, that a potential shareholders rate of return doesn’t change over

time and doesn’t take into account the time value of money. There are more

complex versions which overcome some of these limitations, but if you keep them

in mind, it works as a quick and easy evaluation technique.

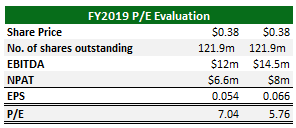

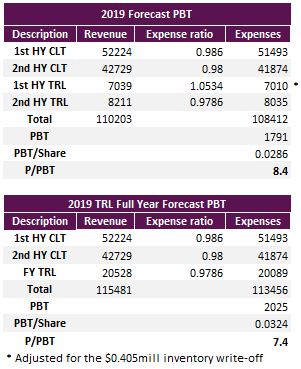

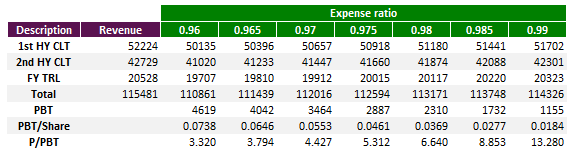

Using Shaver Shop’s FY2019 EBITDA guidance and the historical NPAT/EBITDA ratio, we can calculate possible EPS for FY2019 and using this, see what P/E the share is currently trading at. Below you can see that assuming we have no large hiccups, Shaver Shop is currently trading at between a 5.5 and 7.5 P/E ratio, quite low, but in my opinion not too far off where I would expect them to be.

Before we begin, here is a refresher on Shaver Shop, click here.

HY Report

Shaver Shop has a mixed start to the fiscal year, they

achieved a 7.7% increase in sales (ex. Daigou), with online sales increasing a

further 10.6% (1H 2018 66.6%) to now form 12% of total sales. This sounds

great, but then you continue on and see that they actually increased their

store count to 113 (7 stores in 6 months) and their like for like store sales

decreased by 5% (flat if you exclude Daigou re-sellers).

Another half year achievement was the increase in the gross

margin of 1.3% to 42.7%, which is a total 5 year percentage change of 3%, very

impressive considering how much Shaver Shop has expanded over those years and

the reduced Aussie dollar. Unfortunately, whilst they may be having success in

reducing cost of goods sold, their other expenses are increasing

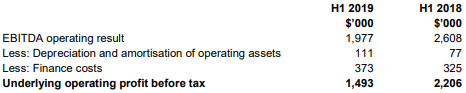

disproportionately to revenue. As you look down the margin table below, you can

see that all of the other margins are decreasing year on year, with Net Profit

After Tax (NPAT) decreasing 1% pcp, taking the total 5 year percentage change to

-32.7%.

When we breakdown the expenses

and calculate them as a percentage of total revenue, the increasing culprits are,

employee wages, 2.1%, occupancy, .5%, and other expenses, 1.2%. Marketing

continues to be the area Shaver Shop is targeting their cost cutting, reducing

by another 1.2% pcp (just over a $1mill) and halving over the last 5 years.

Shaver Shop stated in their

conference call, that they are moving away from the more traditional and

expensive advertising mediums (television, print, etc.), towards the cheaper

online marketing campaigns, which can explain some of the reduction in their

marketing spend. I understand their desire to reduce this expense, it’s an easy

one to reduce with little revenue impact over the short term (it does help

their margins as well), but as competition increases, they need to be

differentiating themselves from other companies, especially online, such as

Amazon. Why would a customer choose to go to their website, what advantage do

they offer in this space? In store is a different story, they have a

consistently high Net Promoter Score (NPS), but as customers are becoming more

sophisticated, many doing their own research before even setting foot in the

store, this competitive advantage will be eroded away. Consumers are obviously

moving towards online, Shaver Shop can see this move and are therefore

promoting online more, but again, what can they offer a potential customer that

Amazon or another big retailer can’t, a bigger discount? Fast delivery (Good

luck beating Amazon on this one)? A simple to use website, with a streamlined

purchase process and a limited number of purchase pain points? None of these or

others I can think off gives Shaver Shop any advantage over other online

websites, in my opinion they have no online competitive advantage.

Evaluation

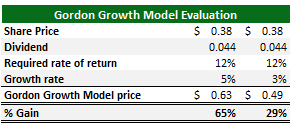

As you can see below, assuming

that Shaver Shop continues to payout a $.024 dividend in the second half and

using growth rates of 5 (roughly the dividend growth rate over the last 2

years) and 3 percent, we calculate a share prices offering a 65 and 29 percent

increase on today’s values. Quite encouraging, but are these growth rates

achievable over the long run? When doing the final overview of the evaluation

results, I wouldn’t put too much weight on this one.

Using Shaver Shop’s FY2019 EBITDA guidance and the historical NPAT/EBITDA ratio, we can calculate possible EPS for FY2019 and using this, see what P/E the share is currently trading at. Below you can see that assuming we have no large hiccups, Shaver Shop is currently trading at between a 5.5 and 7.5 P/E ratio, quite low, but in my opinion not too far off where I would expect them to be.

Discussion

Using historical references, Shaver Shop is currently

looking cheap, but with the limited growth opportunity available, it appears

about right. They did look at an acquisition over the half, rumoured to be

Hairhouse Warehouse, which after costing them $1mill in due diligence, they

decided against it. I’m sure that they made the right choice, but instead of

looking for further growth opportunities, they have decided to increase the

dividend payout ratio and suspend share buybacks (Somewhat contrarian to other

companies willing to buy back their stock at any price, but further cements my

opinion that they are currently priced roughly right). During the conference

call, an investor asked if they would be looking at other potential

acquisitions, with Shaver Shop stating (not exact quote) that if a very obvious

buy hit them in the face, they would obviously purchase, but they are not

currently looking. Which is a shame, a growth plan (along with the increase in

stores) would be great, even if it isn’t an acquisition, maybe something like

focusing on expanding into NZ market more could be a good option. Anything

would be good, they are nearing the top of the number of stores Australia can

handle, having already started to talk about store cannibalisation (the close

proximity of stores, moves sales from one store to another). Obviously

this is something all retail companies need to worry about, but I didn’t think this

would be something they needed to worry too much about this far away from their

goal of 145 stores.

The real question is what is Shaver Shops competitive

advantage (moat)? In store they have excellent customer service. But as many

customers are doing their own research before entering the store, for a large

number of customers, the store is just the place they purchase the product they

had already mentally purchased before setting foot in store. The future is

online and here I really struggle to see what they can offer over other online

stores, especially ones without brick and mortar stores, with low fixed costs

and therefore larger margins. For a long time to come, there will always be

people who enjoy the brick and mortar experience, but as this number is

dwindling, so too will Shaver Shop’s advantage.

Conclusion

Shaver Shop on the face of it looks like a screaming buy,

but when you step back from the numbers and look at the whole landscape I

believe that they are priced about right. They are an excellent dividend stock,

having increased their payout ratio of cash NPAT from 50% to between 60 – 80%,

but with little growth opportunities and the decrease in available funds, I

believe they will continue to shoulder on, paying out a great dividend over the

short to medium term, until they can’t anymore.

If you would like to read another retail HY report, check

out my recent Cellnet article here. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

The author is a current owner of a portion of Shaver Shop, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action