FY19 Portfolio update ASX:LBL, SOP, DEM, 2BE, XRF, BSL, SSG

04/09/2019

Trav Mays

Follow @MaysTrav

Today I would like to give an update on all the stocks within my portfolio and see how my original thesis has/is playing out. I plan to write another post about other companies that aren’t in my portfolio but I have written about in the past to test my thesis and hopefully learn a bit more.

I run a very concentrated portfolio because the benefits really resonate with me. I completely understand diversification and its merits, but I struggle to keep up with this many stocks, so adding another 13 or so to get diversified sounds like a nightmare, but each to their own. The figures in the table below are just a snap shot as of end of business day today (04/09/19) and should not be looked at as an indication of performance.

*Weighted average price

LaserBond (ASX:LBL)

BlueScope Steel (ASX:BSL)

After going through my analysis I decided to sell BSL today (04/09/19) for $12.33, netting me a return of 11.6% + dividends - brokerage and tax in 9 months, pretty happy with that. The reason I decided to sell is due to increased uncertainty. The trade war continues to drag on, with steel being a key lever both sides are using to hurt the other. BSL has also been spending a lot of money on buybacks, helping to keep the stock price somewhat elevated despite the decrease in profit and predicted large decrease in FY20. If the buyback where to stop before the trade war ends, I would imagine it would hurt the share price in the short term. They have also just started proceedings with the ACCC over alleged steel price fixing. It doesn't sound like they have a very solid case, the ACCC's Chair Mr. Rod Sims stated that due to them only having 6 years to begin civil proceedings and that time is almost up, the "ACCC has determine it is appropriate to commence such proceedings against BlueScope and Mr. Ellis", not the most confident sounding reasoning, but adds to the uncertainty around BlueScope. Whilst I think it is still undervalued, I would rather wait and watch on the sidelines than continue to own a stock whose profits are so heavily tied to the a ongoing disagreement between two of the most powerful people on the planet and get back in if it does happen to go down.

Synertec (ASX:SOP)

Original thesis can be read here

Synertec looks to be playing out as expected, albeit, slightly postponed, except for their revenue, I didn’t predict anywhere near that big a jump (111.2%). They also recorded decent increases further down the income statement, with EBITDA returning to positive figures that being said, they did produce a loss in FY19 of $85k.

The original thesis revolved around a new accounting standard (IFRS 15, introduced on the 1st January 2018) temporarily disguising earnings, which continues to be the case. We can see this by looking at the disconnect between operating cash and EBIT, EBIT for FY19 was a loss of $40k whilst Operating cash was a positive $0.83m. We can also see that despite SOP recording an EBIT loss in FY18 and FY19, cash and cash equivalents has continued to increase. If you have read my initial post, you would have seen the simple calculation process that reveals SOP's true earnings, which accounts for all but 50k of the 2.4m increase in the cash balance, as calculated at HY19. This hidden profit, I believed, would eventually be put through the income statement, boosting profit and would be the catalyst for a ~40% stock price gain. But despite the deferred income decreasing by $2.4m in FY19, SOP produced a loss, so what is going on?

I believe the missing profit has been postponed due to some untimely project completion dates; $8.46m worth of projects plus a custody transfer skid were delivered within the first 2 months of FY20. Under IFRS 15, contracts with multiple performance obligations record revenue as each performance obligation is meet, contracts with payments upon completion are recorded "when control of the goods transfer to the customer". Whereas "operating expenses are recognised in profit or loss upon utilisation of the service or at the date of their origin". This means that whilst expenses are recorded as they occur, revenue is recorded only after a milestone is achieved, any cash received before the milestone is recorded as Deferred Income on the balance sheet under Liabilities. As the projects pass their milestones, the deferred income reduces as it is recognised as revenue. The final portion of the revenue both received as cash and recognised on the P&L for the projects finished early FY20, I believe, would have occurred on delivery in FY20, hence the lower deferred income and loss for FY19. While we are not given figures for the custody transfer skid or contract specifics, it's a good bet that they would be settled as cash on delivery, revenue would therefore be recorded in FY20, its costs however, would have all been recorded as they were incurred, the majority of which was in FY19. The same can be said for the performance obligation contracts, the final portion of the payment will be received in FY20, but a large portion of costs would have been expensed in FY19. The 238% increase in the materials and services expense and the 2H19 operating cash loss of $0.42m, I believe, help to validate this point.

Whilst a good portion of the revenue and profit disconnect can be attributed to the accounting standards and untimely completion dates, part is due to the revenue increase coming from the lower margined fixed priced project segments. This segment's revenue increased by 166%, making up 87.3% of total revenue, whilst their other division, rendering of services, decreased by 13%. It would appear that SOP is pricing their projects with a low margin to help win market share, allowing them to show off their skills and talent and to win customers over. Clearly there is a short window in which a strategy like this can be used, but if used correctly, can really help to boost long term shareholder value.

SOP continued to invest in themselves during FY19, they in actual fact accelerated their spend, with business development more than doubling and Employee and Super costs increasing by $1.33m or 21%.

SOP continued to invest in themselves during FY19, they in actual fact accelerated their spend, with business development more than doubling and Employee and Super costs increasing by $1.33m or 21%.

I believe SOP is still good value at current prices, they have no debt, are op cash positive and according to their investor presentation have a medium term target of $40m revenue, with above industry average margins. They seem to be focusing on their custody transfer skids as a large driver of growth, a little more sales info about these units, projected sales volume, a ball park sale price and margin would be appreciated. But nothing stood out as a worry for me, so I'm going to continue to hold. The 1H20 report is the one I am really interested in, within it will hopefully be a return to healthy margins and proof of my thesis playing out, bring with it the ~40% gain I'm predicting. Fingers crossed on this one, I do however believe the risk reward ratio is positively skewed in my favor.

Shaver Shop (ASX:SSG)

Original thesis can be read here and the half year result here

Shaver Shop along with a number of other large retailers had a pretty good year. Despite the constant retail apocalypse discussions, SSG grew NPAT by 6%, they hit the lower end of their EBITDA guidance, 12.5m and increased their online sales by 30%, which contributed 12.6% to total sales. But more importantly, they grew LFL sales, 1.1% overall and 4.8% when you exclude Daigou sales.

Over the year they have made a number of improvements, they opened 6 new stores and bought back one franchise. They also improved their website, initiated a number of online incentives and completed 8 full store refits.

Using the PEG ratio, SSG looks priced a little bit higher than it should be, currently sitting on a PEG of 1.5, when using FY19's earnings growth rate of 6% (P/E = 9.14), but is this level of growth justified? So far in FY20, they have increased LFL sales by 9.5% and bought back 2 franchises. Within FY20 they are planning on increasing their marketing spend back up to FY18 levels and refitting 5 - 10 stores with the new design. The franchise buy backs are especially important as they are typically in locations that generate higher sales per store. So they are definitely off to a good start to the year. So it does seem like 6% is a bit low, but it is far too early to tell, as with most retailers, so much of their revenue comes from the holiday season, that any prediction without a little bit of holiday data is pretty much pointless.

During the conference call, Mr. Cameron Fox, current CEO, made an interesting comment. He stated that SSG are using each store as a type of warehouse, whereby as an item is purchased online, the sale order is sent to the store nearest to the customers location, who then, during down periods, package and post the online sales. Clearly this is an excellent idea to try and reduce postage times and costs, keep employees busy during down times and to combat Amazon's 2 day delivery, but one that would need to be managed really well.

Given all this, I am going to continue to hold and watch, they are paying out a pretty healthy dividend, so assuming everything stays the same or doesn't deteriorate too much and I don't have any other company I want to buy, I'm happy to hold.

De.mem (ASX:DEM)

DEM on the surface didn't have a very good half, revenue decreased by 37% (HY19 $3.7m) whilst their NPAT loss more than doubled (HY19 -$1.8m). But when we have a look a little further down in the report, at the cash flow statement, a different story emerges. DEM increased their receipts from customers by 9.3% (HY19 $5.08m) and whilst they produced a operating loss of $0.8m the vast majority of it, ~74%, was from the first quarter, showing that they are making progress towards becoming operating cash flow positive. Not only that, but DEM is predicting to surpass CY18's revenue of $10.5m, with $9.5m worth of revenue having already been secured.

Whilst all of this is great, my key take away from the report is that DEM has begun to untether themselves from the mining and infrastructure industries whilst expanding their geographical footprint. DEM states that "while the vast majority of CY 2018 revenues were generated from the mining/resources and infrastructure segments, the revenue mix for CY 2019 includes some contributions from projects in the food & beverage sector". They went on to state that "a key pillar of the expansion strategy for 2019 is to aggressively target the high growth food & beverage and agricultural sectors across Australia". DEM is also expanding their geographical footprint, having set up two new offices in Adelaide and Melbourne, they also acquired PumpTech (07/08/19), Tasmania's equivalent of Akwa-Worx. A recent announcement really highlights these two points. DEM reported on the 28/08 that they had received two purchase orders for a total of $0.35m, the first order was for a water treatment system in WA, ordered by a WA government organisation, whereas the second order was for a waste water treatment system for a company working in the Food & Beverage industry based in the Pacific Islands region. Whilst the value is not very high, it shows that they are making further progress towards these two goals.

Nothing in the report stood out to me as a worrying sign. I believe DEM is still great value at today's prices and will be able to generate a shareholder return around the 30 - 40% mark in the not to distant future, with the potential for a lot more over the coming years if management performs well and they get a bit of luck on their side. To achieve this, I believe DEM will need to continue to ride the increasing infrastructure spend all the while investing the proceeds back into the business, helping to further expand their customer base industrially and geographically. Signs of DEM departing from this plan is what I will be looking for in the future, but as they currently stand, I am going to happily continue to hold.

TUBI (ASX:2BE)

Original thesis can be read here

Tubi performed really well over the year, they exceeded my revenue prediction by $4.5m, increasing year over year by 82%. They did however fall slightly short on my NPAT prediction, missing it by $0.17m. Their NPAT figure however includes a $0.95m listing expenses, when we adjust for this, EBIT increases to $3m (9.74% margin) and after we remove $0.92m of tax (30% tax rate), NPAT increases to $2.15m (6.8% margin), ~$0.5m higher than I had predicted.

The reason my prediction missed the mark by so much, was due to 2BE generating revenue per month far higher than they have in the past. Over the last 6 months of FY19, Tubi had one plant producing in the Permian Basin which generated $14.4m, or $2.4m per month. My estimate had been the average between the revenue received over the year in NZ and the 2 months in the Permian Basin, $1.65m per month. At the time I was aware that the 2 months in the Permian Basin figure I had used was conservative and would increase as the team became accustom to the factory and site, but I didn't expect that they would be able to increase it by $0.75m.

Along with missing the mark on the rev/month, I was also quite a way off on the sale price of the Iplex unit. Due to me underestimating the amount of revenue per month the plants would generate, I overestimated the cost of the Iplex plant, its actual cost was AUS$9.28m, of which, 40% has already been received with the remaining 60% to be received when the plant is delivered in FY20.

This report gave us some more valuable information about potential future revenue, so I believe an update of my old projection is warranted. To keep the projection conservative, I won't update the assumptions, despite the fact that the plants are currently ahead of schedule, I will just update the rev/month figure, the Iplex plant sale price and use FY19's adjusted figures. FY20's revenue therefore consists of 18 months (1.5 plants) of production at the new higher rate plus the remaining 60% of the Iplex plant. Whereas FY21's revenue is for 4 plants producing for 12 months, 2 at the new higher rate $2.4/month and 2 at the more conservative lower rate of $1.65m/month.

This report gave us some more valuable information about potential future revenue, so I believe an update of my old projection is warranted. To keep the projection conservative, I won't update the assumptions, despite the fact that the plants are currently ahead of schedule, I will just update the rev/month figure, the Iplex plant sale price and use FY19's adjusted figures. FY20's revenue therefore consists of 18 months (1.5 plants) of production at the new higher rate plus the remaining 60% of the Iplex plant. Whereas FY21's revenue is for 4 plants producing for 12 months, 2 at the new higher rate $2.4/month and 2 at the more conservative lower rate of $1.65m/month.

The updated information paints 2BE in even better light than my original post. If we look one year out, we have a PEG of 60.7, whereas if we average the next 2 years growth, we have a current PEG of 24.5. Very encouraging figures, especially when we consider that I have not taken into account the Iplex service agreement, the fact that the plants are currently slightly ahead of schedule and my conservative assumptions. I did however make a large amount of assumptions, so this prediction should be looked at with skeptic eyes, you can see how wrong I was last time I tried to predict. Given all this, I believe that the risk reward ratio is currently in my favor and at current prices, continues to offer good value. If you'd like to read more about Tubi, I have referenced and linked Mr. Joshua Baker's report on both XRF and Tubi at the bottom of the XRF section, he goes into more detail about their progress and is an excellent read, highly recommend.

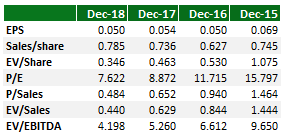

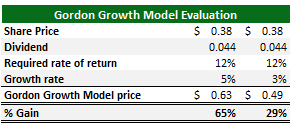

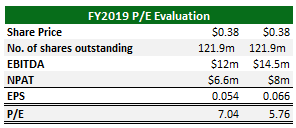

XRF Scientific (ASX:XRF)

Original thesis can be read here

XRF had a bumper of year, having gone through an inflection point, they increased revenue by 20%, NPAT by 109% and Op cash flow by 380%. They also moved closer to turning the German office profitable, recording 2 months in the 2H19 with positive profit.

Along with this, PBT margins were increased across the board, with the standout being precious metals increasing to 7% and contributing 25% of the total PBT, up from 3% in FY18.

Ricky (twitter:@galumay) has put forth a number of valid arguments against XRF on twitter over the last couple of months. The two that I believe could pose a serious threat are, the fusion machine's ability to process large quantities and their long life span. As a mine site ramps up production, no additional fusion machines are needed to meet the higher level of output and with the replacement life cycle being so long, without new mines opening up, the sales growth rate within this segment could slow down or reverse. If we look at XRF's geographical revenue breakdown we can see that within Australia there was a large increase in the Capital Equipment segment, but flat in Consumables. We can lightly infer from this (consumables can be purchased from competitors) that a good portion of these purchases are replacements, which is also confirmed by XRF within the report. Higher commodity prices are currently pushing mining profits up, with the ABC reporting a 12.5% increase over FY18, so assuming this continues we should hopefully see capital equipment profit levels hold steady or slightly increase over the next 2 - 3 years (This is really a guess). XRF have also stated that they are focusing on growing the services and parts divisions and are planning to launch new products in FY20, opening up new organic growth opportunities.

Excerpt from XRF Scientific FY19 annual report

The consumables division did well, the continued reduction in Lithium prices helped to push NPAT to record levels, increasing by 35.3%, despite revenue increasing by only 6.16%. Expanding XRF's consumables market share is another area of growth XRF has stated they are targeting.

As I said earlier, precious metals is the real stand out here, this division appears to be on the cusp of an inflection point and in my opinion is where the future growth will stem from. The German division's progress to becoming profitable has allowed XRF to reduce their precious metal expansion costs by half ($0.3m FY19, $0.743 FY18) and to increase profits to $0.925m, up from $0.556m in FY18.

So what does this mean for XRF? I believe XRF is well positioned to continue to benefit from the pickup in the mining industry, giving them a couple of years of similar or higher capital equipment revenue, this along with their decrease in precious metals expansion costs, higher margins and organic growth opportunities will help to push earning higher into the future. Hopefully, they will pump a good portion of this back into the company helping to expand their product mix through either acquisitions or product development. They have stated that they are looking to expand internationally and that they are pursuing M&A opportunities, so this is looking promising. The rest will probably be distributed to share holders, as Mr. Joshua Baker states in his recent article "Results Update: Platinum Gilded Numbers & Close to Light at the End of the Tube", "I believe the company would be able to make a material capital return to investors via a special dividend, which would also allow XRF to distribute the benefit from the $5.7m in franking credits accrued on the balance sheet".

Given all this, I am happy to hold, but I will be watching for any signs of Ricky's fears playing out. I am however going to push my estimate of the share price up to $0.3, with the possibility of more if management perform well and they continue to have luck on their side.

As always, thanks a lot for reading. I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect or would like to chat, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect or would like to chat, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect or would like to chat, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

if you’d like to connect or would like to chat, it’s always great to meet other ASX investors, especially those who have a different view point and don't forget to subscribe to ensure you don't miss out on my new posts.

Thanks for reading

Just Culture Investor

Trav Mays

Sources:

1. https://www.livewiremarkets.com/wires/results-update-platinum-gilded-numbers-close-to-light-at-the-end-of-the-tube

2. https://www.abc.net.au/news/2019-09-02/gdp-economic-growth-slow-down-business-indicators-profit-mining/11471034

The author is a current owner of all shares outlined above, given this, they may be subject to one or a number of biases, more specifically anchoring and/or confirmation bias. This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action. Please refer to Disclaimer page for a full list of disclaimers.