BlueScope Steel an excellent Value Company (ASX:BSL)

|

| Port Kembla Source: www.bluescopesteel.com.au |

Trav Mays

Follow @MaysTrav

Description

BlueScope Steel (ASX:BSL) is a “global leader in premium

branded coated and painted steel products - the current largest manufacturer of

painted and coated steel products globally”. BlueScope has 5 major segments,

Australian Steel Products, North Star, Building North America, NZ & Pacific

Steel and Building Products Asia & North America. These segments are spread

out over 17 countries with more than 100 facilities and 14,000 employees.

Whilst having a large array of brands under the BlueScope banner, their main

brands are Colorbond, Clean Colorbond and Zincalume steels, Lysaght steel

building products and Butler and Varco Pruden engineered buildings.

History

BlueScope listed on the ASX on 15th July 2002 after it

split off from BHP and as with many manufacturing companies, it has had a

turbulent ride since then. The share price initially increased from the IPO

price of $11.14 to just over $48 in 2007, before falling to a low of $1.6 in

2012. The effects of the Global Financial Crisis were extended for BlueScope, as the

global economy contracted, the iron ore price increased by an astronomical

amount, from below $40/tonne in 2007 to over $180/tonne in 2010. These high

coal prices along with a strong Aussie dollar and low steel prices lead

Bluescope to post over a billion dollar loss in 2011.

To combat this, Bluescope ceased all exports from their Port

Kembla Mill, resulting in ~800 employees being stood down and a further 200

jobs being lost at the Western Port Steel Mill. Macro conditions improved over

the coming years, however Bluescope continued to struggle to make a profit with

the 90 year blast furnace at Port Kembla, again considering shutting it down in

2015. It was during these deliberations that Bluescope expanded further into

America, purchasing the remaining 50% of the North Star Mill, taking their

control to 100%. This increased their percentage of non-current assets in America from 17%

to 44%. This formed part of

a strategic move away from Australia, beginning in 2010, Bluescope began to

expand into New Zealand, Asia and America, almost halving their percentage of

non-current assets in Australia, 63% in 2010 to 36% in 2017.

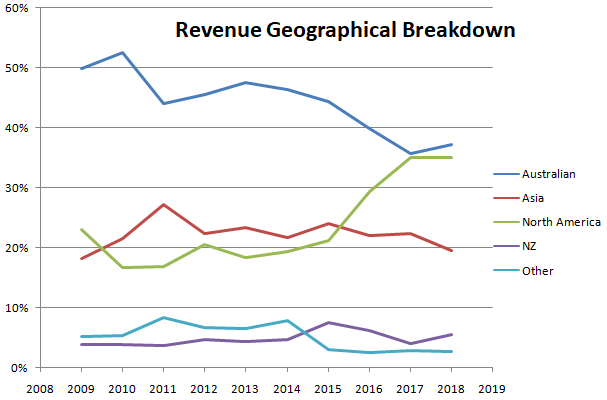

The movement of assets translated into a movement of their revenue base. Revenue sourced from Australia reduced from 53% in 2010 to 37% in

2018, whilst in America it went from 17% to 35%.

One of the largest costs facing Australia at the moment is

electrical costs. BlueScope always looking to the future and for potential

opportunities, has entered into the largest solar Power Purchase Agreement with

ESCO Pacific and Schnider Electric. The 7 year agreement will supply roughly

20% of BlueScope Australia’s Electrical requirements, taking most of the 133MW

output of the Finley Solar farm, located 100km west of Albury.

Competition

The 2017 acquisition of Liberty Onesteel would have been an excellent

opportunity to price BlueScope, however as it was purchased by the private

conglomerate GYG Alliance, the price they paid has been kept a secret.

Nevertheless, BlueScope has many other competitors for comparison, especially with

their further expansion into North America.

As you can see

below, using a number of the common value metrics, BlueScope is by far the better purchase

at current prices. BlueScope is not only ranked the overall best but has the best

values in 7 out of the 11 categories and isn’t last in any of them. US Steel

scored the second lowest, however the difference was still 10 points higher

with the rest scoring double or more than BlueScope. From a business perspective, BlueScope has the highest profit margin and lowest Debt/Equity. In fact, they are

actually net cash positive, with $63 million in cash left after paying off all

of their debt.

The similar Pitroski score shows that the gain in 2018 was

seen across the industry and therefore was a result of outside influences, iron

ore prices, steel prices, Trump’s election and protectionism etc. We therefore

cannot allow the Pitroski score to have much of an impact on the eventual

decision. It also needs to be said, that as a large number of these metrics are

related to price, the lower share price of BlueScope will cause this type of analysis

to favour BlueScope. The cause for the large decrease in share price needs to be

further examined before a final decision can be made.

Evaluation

On a comparison basis, BlueScope is by far the superior steel

manufacturer, however just because it is has scored the best, does not mean

that it is currently mispriced enough to warrant purchase, especially when

taking into consideration the need for a sizeable margin of safety.

Joel Greenblatt made the enterprise value (EV) multiple a

popular analysis technique. By using the average industry and historical

multiples, you can compare the current price with those paid historically and

industry wide. Using the industry average EV multiple of 6.56 results in a BlueScope's share price of $22.6 a 104% increase on current prices, whilst using BlueScope’s 5

year average gives an increase of 83% to $20.27/share. The returns are of

considerable size, however as with all evaluation techniques, these are just a

small component of the overall analysis. The reason for the downbeat share

price needs to be thoroughly investigated.

While share price increases will make up the bulk of any

gains you make once purchasing a business, the total return to the shareholder

including dividends and buybacks is more important. BlueScope has tendered to buyback

shares, which for a long term investor, assuming that the share price during

the buyback is trading below its intrinsic value (read excellent commentary

about that here),

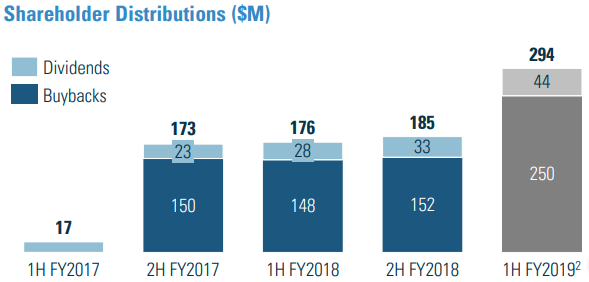

is the best use of a company’s excess capital. BlueScope returned ~22% of its 2018

profits and is set to continue returning value to share holders, having already

begun another $250 mill buyback.

Possible Causes of the Current Share Price

Despite BlueScope earning a large profit, the share price has been

falling from a high of $18.60/share to 52 week lows of $10.56/share.

The potential causes of which are huge, from the dreaded and

unpredictable “tweet” risk to the low AUS/US exchange rate. Below is a list of

potential risks that I believe could have the biggest impact and are therefore

causing the share price to fall.

-

US/The world trade tensions

-

Tweet risk

-

AUS/US exchange rate

-

Trump risk

-

Unstable Australian Government

-

Iron Ore prices

-

Steel Prices

-

China

-

New CEO

-

Global Recession

As you can see, a

large number of these are not BlueScope specific risks but global risks, with the

Trump risk helping to increase short term US profits through tariffs.

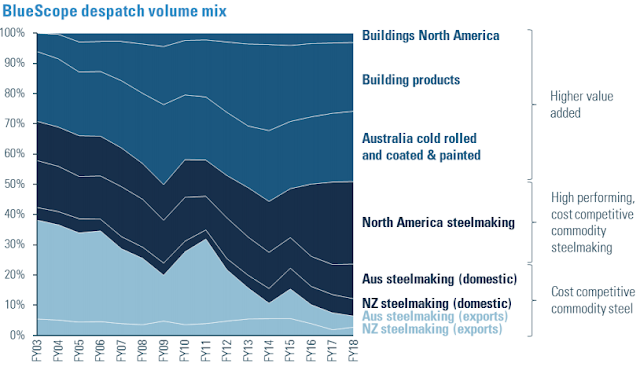

The low AUS/US exchange rate, whilst at one stage would have

had a much larger impact on the Bluescope, has been somewhat mitigated by their

global expansion. As you can see below, Bluescope has decreased the Australian

Steelmaking exports significantly, resulting in the exchange rate only significantly

affecting the cost of internationally sourced or US priced inputs for

Australian manufacturing. The low AUS/US exchange rate will have a positive

effect on the US operations when converted to $AUS.

The appointment of Mark Vassella as CEO was an excellent

choice, given his vast steel industry experience, especially within the US

market. I don’t believe this is having an effect. In fact, it’s my opinion that

it is the uncontrollable effects that are pushing the share price down. The

uncertainty of Trump and the US/China trade negotiations are having a roll on

effect into the iron ore and steel prices. I believe it is these risks that are

causing investors to currently be cautious. Along with this, as with all

industries, China is an ever present behemoth with the ability to create

further chaos for the steel industry. A Chinese economy stimulation package

involving steel production, could cause a large drop in the steel price whilst

increasing the iron ore price; this would obviously have a large impact on

BlueScope. With all the uncertainty a margin of safety is paramount to an

investor’s long term success.

Recommendation

BlueScope Steel, is an excellent example of a value company,

however the reason for the low share price could be warranted. A good

understanding of the major risks is extremely important to facilitate a

realistic risk reward analysis. Fundamentally, whether an Investor chooses to

invest in BlueScope will come down to their global economy outlook. If you are

optimistic, the future is bright, tensions will ease and stability will resume.

However if you are pessimistic, than I would suggest looking elsewhere for an

investment opportunity. I tend to believe the actual outcome will be somewhere

between the two, but more towards the optimistic side of the spectrum. As with

most people I can’t predict the future (read more about that here), I do however

believe it’s time to begin thinking about Warren Buffett’s quote "Be fearful when others are

greedy and greedy when others are fearful".

As a business, BlueScope has very little debt, a global

presence, is net cash positive, ranks higher than other major competitors, is

run by an excellent management team and recently confirmed their 1H 2019

underlying EBIT guidance of 10% higher than 2H 2018 ($745M). They have learnt

from the most recent recession and have reduced their exposure to a given country.

It is due to all of this that I believe that BlueScope Steel will prove to be

an excellent long term investment.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion

of BlueScope Steel, given this, they may be subject to one or a number of

biases, more specifically anchoring and/or confirmation bias. This article is

neither general nor personal advice and in no way constitutes specific or

individual advice. The website and author do not guarantee, and accept no legal

liability whatsoever arising from or connected to, the accuracy, reliability,

currency or completeness of any material contained on this website or on any

linked site. This website is not a substitute for independent professional

advice and users should obtain any appropriate professional advice relevant to

their particular circumstances. The material on this website may include the views

or recommendations of third parties, which do not necessarily reflect the views

of the website or author, or indicate its commitment to a particular course of

action

Thursday, 13 December 2018

Looking for trouble at RCR Tomlinson (ASX:RCR)

|

| Darling Downs Solar Farm |

14/08/2019

Trav Mays

Follow @MaysTrav

1. https://www.rcrtom.com.au/about-rcr/

RCR Tomlinson (ASX:RCR) recently entering voluntary administration, whilst potentially devastating to a large number of people, the thousands of employees and

shareholders especially, offers a great learning opportunity. This post

will try and identify any potential early warning signs that we may be able to

use in the future when examining businesses. This post won’t be an examination

of the managers or the operations of the business, it will be an investigation

searching for any early warning signs within the financial statements only.

Whilst doing this examination, I

have tried to put myself in the position of the shareholder. However, given

that I know the final result I am obviously heavily influenced by hindsight

bias. With this in mind, I would like to make it apparent that I am in no way

criticising any person for either purchasing or hanging onto their shares.

Whether a person decides to purchase or to retain a portion of a business is

governed by many things, such as their risk tolerance, expertise, level of

knowledge, etc. I have made many mistakes, mostly recently Donaco (read about

that one here), my desire is to learn from

history (it’s a shame that we learn more from mistakes than successes), not to

criticise any market participant. Unfortunately learning from history is easier

said than done, as Mark Twain said “History

doesn’t repeat itself but it often rhymes”.

Company

RCR is a 120 year old Australian

Engineering and Infrastructure Company, working with some of the world’s

leading organisations to provide intelligent engineering solutions to the

Infrastructure, Energy and Resources sectors. “RCR’s core capabilities

encompass; development, engineering, procurement, construction (“EPC”),

operation and maintenance of major infrastructure and resource projects. These

include power generation plants (using a wide

range of fuels; solar, wind, battery and hydro), water and waste treatment systems, rail and road tunnel infrastructure, rail signalling and

overhead wiring systems, mineral processing and material handling plants, integrated oil & gas services

(both onshore and offshore), supply of RCR proprietary materials handling and process equipment,

and property services including facilities management, HVAC and electrical services”1.

They have had a wild ride in the

stock price, recently reaching highs not seen since just before the 2007 bust

and the 2014 oil price dive with a subsequent fall similar to that seen in 2008.

|

| RCR Tomlinson's Share Price |

Warning Signs

Gross Margin

The gross margin showed clear

signs that something wasn’t right at RCR and that further analysis was

warranted. As you can see below, after improving their gross margin to a very

impressive 9.9% in 2014, it fell dramatically, to 5.1% in 2016 and continued on

its downward trajectory to 1.34% in 2018.

|

| RCR Tomlinson's Share Price |

Gross margin between 2018 and

2015 was being squeezed due to a disproportionate increase of revenue (93%) and

cost of sales (111%). As you can see in Table 1, the main culprits up to 2018

for the increase were materials and other costs with employee benefits further

exacerbating the expense in 2018.

|

| RCR Tomlinson's Cost of Sales |

Breaking this down further in to

RCR’s operating segments, it is clear that the initially it was just the energy

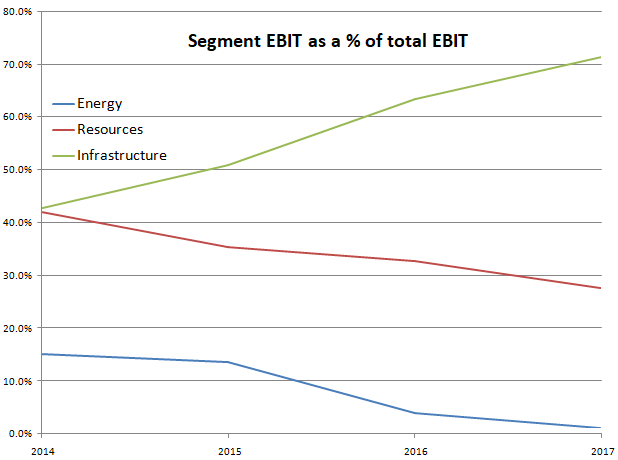

segment, reducing its EBIT margin to 1% from 5% in 2016. The energy and resources

segments include RCR’s power generation and mining operations, as with all

companies operating in these segments, they were hit hard by the extreme drop

in the oil price in 2014. The 2018 recovery of energy would be partly due to

the recovery of the oil price, with WTI crude reaching a high of US$74/barrel, still

far shy of the pre 2014 crash highs of US$105/barrel.

|

| RCR Tomlinson's Gross Margin |

One of RCR’s main core

capabilities of the infrastructure segment is the renewable energy systems,

where they offer all engineering facets, design, construction, commissioning,

operation and maintenance. Whilst the administrators are still examining the

firm’s financials for the cause of their recent troubles, it is believed that

RCR took on renewable energy contracts without a firm understanding of

connection risks. Along with this, it has been stated that they offered fixed

contracts, resulting in all project over run costs being borne by RCR. These

two underlining issues came to fruition in 2018, resulting in a large loss for

the infrastructure segment of $9.8mill, far below the trailing 4 year average

profit of $30mill. This is especially troublesome for RCR, as over 70% of their

EBIT in 2017 was generated in the infrastructure segment.

|

| RCR Tomlinson's Segment EBIT as a % of Total EBIT |

Trade and other payables

Another troubling sign was the

huge increase in trade and other payables, increasing from 35% of equity in

2016 to 110% in 2017. Between 2009 and 2016, trade and other payables was an

average 46% of equity, between 2017 and 2018 it increased to 116%. Interestingly,

as their trade bills increased they continued to pay down their borrowings,

reducing their borrowings/equity ratio by an impressive 73.5% between 2014 and

2018.

|

| RCR Tomlinson's Debt/Equity |

Discussion

In 2016, the reduction in gross

margin could be attributed to an unfortunate project running over time and/or

cost, but when the trend continued in 2017 a deeper evaluation was clearly warranted.

This evaluation would have unearthed the huge increase in trade and other

payables, this along with a shrinking margin should have been a huge red flag

for owners, signalling that something wasn’t right. It’s easy to type this

after the fact, I too could have been persuaded by the rising share price, as

it trotted it was up to a 249% increase in a year and a half. Along with

this, a lot of great analyst believed the same and typically when they are all

in agreeance, they are usually right. Unfortunately on this occasion they were

not.

I could continue to say things

such as they should have renegotiated their debt and paid down their trade and

other payables, focused more heavily on increasing the energy margin, or sold

it off as it was only making a small percentage of EBIT, but these and other

similar statements are built on assumptions made on hearsay and speculation. We

will need to wait for the report from the administrators to make a full

examination.

The main thing I learnt from

this analysis is that trends hold the key to finding issues and signs of areas

that require a deeper dive into the weeds. It also further highlights the need for us to do

our own analysis and to not be swayed by share prices. Once the analysis has

been completed, then compare it to the price you calculated, if it is too high,

sell, if it’s low and gives you a good margin of safety, buy.

I am on Twitter Follow @MaysTrav and Linkedin  if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.

if you’d like to connect, feel free to send me a msg, it’s always great to meet other ASX investors, especially those who have a different view point.1. https://www.rcrtom.com.au/about-rcr/

This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action

Monday, 3 December 2018

My horrible mistake; Donaco International (ASX:DNA)

|

| Aristo Casino, Vietnam |

03/12/2018

Trav Mays

Donaco (ASX:DNA) is the most recent mistake/lesson I have made, so in the spirit of Benjamin Franklin who said “that wise men profit from the mistakes of others, while fools will not learn even from their own blunders”, I write this post in the hope of making myself less of a fool. While all lessons need to be thoroughly investigated, the cost of this lesson necessitates a deeper investigation to ensure that I ring all of the knowledge out of it I can. This post however won’t be a complete list of my errors, there aren’t enough bits of information in the universe to store that list, but it will cover the two largest, focusing too little on management prior to the purchase and my ability to succumb to the anchoring and confirmation biases post purchase.

Company outline

Donaco is the result of the 2013

merger between Two Way (TTV), a gambling applications developer for TV, mobile

and computers and Donaco Singapore, which had a 75% stake in the Lao Cai

International Hotel (now called Aristo) in Vietnam. The new management acted

quickly with a strong focus on the Aristo Casino, selling the TV wagering

service, initiating a $52mill upgrade to the casino and increasing their share to

95% (the final 5% is owned by the Vietnamese Government) all within 2013. They

went onto sell and spin off the remaining non casino businesses, Way2Bet and

iSentric, in 2014. In essence, Two Way raised capital through a share offering

to purchase Donaco, it than appointed the Donaco Managing Director as CEO and

sold everything off, transformed itself from a gambling application developer

into an Asian casino owner, despite the fact that not one of the board had any

Casino experience.

Prior to the acquisition of

Donaco, Two Way had not made a profit and in fact had an average year on year revenue

decrease of 6% between 2007 and 2012. Post the acquisition, between 2013 and

2015, normalised profit reduced by 128% from a $9mill profit to a $2.5m loss. Donaco

stated that the poor result in 2014 was “affected by headwinds during the soft

opening period, including China/Vietnam tensions, Soccer World Cup and Yunnan

earthquake, while 2015’s poor result was “due to the VIP growth win rate of

1.64%, which was well below last year’s above – theoretical level of 4.01%”. At

this point, they purchased another casino, Star Vegas in Poipet Cambodia for

US$360mill. Included in the Star Vegas purchase was a 2 year warranty, insuring

that the FY EBITDA will total at least US$60mill per year, with any short fall

being made up by a cash payment by the vendor, who was appointed to the board.

Mistake 1: Management

It was just after this falling

out that I purchased my shares, believing that the reduction in the share price

was a short term reaction to the ousting of the Vendor. I, by not doing my due

diligence, especially when it came to management’s lack of casino experience

and its poor results at the Aristo casino, should have seen that the ousted

vendor/board member, was the only person will any successful casino experience.

The other point that Donaco

stated as having a negative effect on the casino’s result was the opening of

another casino by the vendor. Donaco stated that the vendor was not only

operating the Star Paradise casino but also had another illegal casino

operating out the back of a supermarket. This should have had red flags for me.

If a business cannot operate within a market where they are given a

semi-monopoly by the government, than there is little hope for the business.

The illegal casino that they mention is inconsequential, if an illegal casino

operating out the back of a supermarket is able to affect the results of a

large and established casino by a material amount, than there is something

seriously wrong at Star Vegas.

This is especially worrying due to the fact that between

2015 – 2017, Naga World, Cambodia’s number 1 casino had an average year on year

profit increase of ~22% and in their first 6 months of trading in 2018, have

increased their profit a further ~19.6%. While it could be argued that this is

an unfair comparison, they were subjected to all the same headwinds as Donaco

and instead of making excuses, thrived.

Whether or not what Donaco has

stated is true, there is an underlying theme at Donaco, management’s ability to

blame any poor result on an unforeseen and completely outside influence. This is

the real point that I believe I missed, any person can learn how to manage a

casino, but as Dr. Robert Anthony said “When you

blame others, you give up your power to change” and by not seeing that it was

them, the management that was to blame, they denied themselves the power to

learn, improve and change.

|

| CEO's total compensation vs Donaco's profit |

Mistake 2 Anchoring and Confirmation Biases

In the short term the market

believed as I did, resulting in a 31% gain in a few short weeks. This initial

gain caused me to become overconfident in my abilities. As time went on, this

overconfidence resulted in me developing 2 very powerful biases, anchoring and

confirmation.

As you can see below, I went on

to purchase shares 2 more times over the next year, all the while believing

that I would sell them once they went back up to ~$0.35 and I could get back

that initial gain of 31%. I, as Benjamin Graham

said is a mistake, confused speculation with investing and paid dearly for it,

resulting in a 67.4% loss.

|

| Donaco Share Price and my Purchases and Sales Nov 2017 - Dec 2018 |

Warren Buffet summed me and this mistake up perfectly when he said "The

line separating investment and speculation, which is never bright and clear,

becomes blurred still further when most market participants have recently

enjoyed triumphs. Nothing sedates rationality like large doses of effortless

money. After a heady experience of that kind, normally sensible people drift

into behavior akin to that of Cinderella at the ball."

Catalyst

The reason I sold out in the end

was not due completely to Donaco’s 2018 normalised profit reduction of ~64%, it

was Donaco’s management again blaming outside influences, stating the result

was again due to the usual excuses, with the addition of Chinese organised

crime scaring off customers.

Conclusion

If this post has painted Donaco

and its management in a horrible light, this is not my intention. I have chosen

to only include some of the points that should have shown red flags prior and

post my purchase. I didn’t talk about the good work that has been going on at

Donaco, the addition of night clubs, restaurants, online gambling apps, etc.

that my confirmation bias used to keep me hanging on. And it may very well be

true, that Donaco has been unfairly impacted by headwinds and that the

management has done an excellent job navigating them, but the point is, that I

should have never purchased a portion of Donaco. The uncertainty around the

ousting of the vendor means that this was a purely speculative purchase and I

am not in the speculative game. I try to purchase businesses similar to Charlie Munger and Warren Buffet as a business owner, not as a stock owner.

This post – mortem has uncovered

two very large flaws in my evaluation process. While the current accounting numbers

are extremely important in the screening of possible businesses, it’s the management

that I need to focus more heavily on. They are the ones who are deploying the

capital and therefore have total control over any future returns. My other

biggest learning’s are to do a pre-mortem and to be more realistic in my

evaluations after the purchase.

Looking back is easy, as the

proverb states, after the ship has sunk, everyone knows how she might have been

saved and I just hope I have learnt how to save myself next time.

This article is neither general nor personal advice and in no way constitutes specific or individual advice. The website and author do not guarantee, and accept no legal liability whatsoever arising from or connected to, the accuracy, reliability, currency or completeness of any material contained on this website or on any linked site. This website is not a substitute for independent professional advice and users should obtain any appropriate professional advice relevant to their particular circumstances. The material on this website may include the views or recommendations of third parties, which do not necessarily reflect the views of the website or author, or indicate its commitment to a particular course of action

Tuesday, 27 November 2018

Turnaround success at Cellnet (ASX:CLT)

27/11/2018

Trav Mays

Follow @MaysTrav

Description

Cellnet (ASX:CLT), formed in

1992, is a market leader in the warehouse and distribution industry with

centres in Australia, China and New Zealand. Their main source of revenue is

warehousing and distribution, however they also own the 3SIXT technology brand,

selling everything from phone covers and screen protectors to action video

cameras. They are currently the exclusive supplier to Optus, Vodafone, Noel

Leeming and Lagardere, where they manage each peg, giving Cellnet up to date

information on stock levels and customer preferences.

Cellnet by 2014 had become

unfocused, increasing the number of brands in their fold to 72. As with Icarus, the wings that were originally their source of

success, lead to their eventual downfall. Whilst the additional brands were

bringing in more revenue, Cellnet’s expenses accelerated at a faster pace,

culminating in a large loss in 2014 and the removal of the then current CEO and

appointment of Alan Sparks to replace him.

Cellnet under the excellent

management of Alan Sparks, have achieved a remarkable feat, as Warren Buffett

says “Turnarounds seldom Turn”, Cellnet, defying the odds, falls into the

seldom group. Mr. Sparks began by cutting the expenses and streamlining the

business, reducing the number of brands to just 12 in 2014. Despite the smaller

number of brands, Cellnet has modestly increased revenue, however their

greatest achievement has been in the reduction of expenses. This is seen

through the large disparity in revenue to profit growth, revenue grew an

average of 5.2% pa whilst profit grew an average of 15.9% pa. These numbers are

heavily affected by the loss in 2014 and the subsequent recovery of 2015. A

better representation of Mr. Sparks and his team’s efforts is the last three

years, where they have achieved an average per annum revenue and profit growth

of 4.6% and 25.1% respectively.

To further help Cellnet reach its

potential, a partner was sought who not only understood the business, but would

bring with them knowledge and synergies, they found WentronicHolding GmbH. Wentronic purchased 79.77% (56.19%, 2018) of Cellnet in

2016 and with it, it brought over 25

years of knowledge and experience operating a similar and considerably larger

business than Cellnet. Wentronic is a privately owned warehouse and

distribution company with over 300 staff, 12000 products and 5 branches

throughout Europe and Asia. Wentronic opened up supply chain channels that

Cellnet couldn’t have gained alone, contributing significantly to the reduction

in expenses. Further to this, Wentronic and Cellnet in 2018 entered into a

joint venture company (51% Wentronic, 49% Cellnet) incorporated in Singapore,

Wentronic International Pte. Ltd. The purpose of which is to expand the

Wentronic and Cellnet products into markets outside Europe, Australia and New

Zealand, with both companies proportionately picking up the bill.

This joint venture coincided with

another development in 2018, 11.4% of Cellnet’s shares were purchased by a

strategic Partner JEJ, the investment vehicle of Cybernetic

of Taiwan. Cybernetic has been distributing Philips (Mr. Sparks worked for

Philips for over 7 years) accessories since 1993, shipping to many counties

including Taiwan, Turkey, Middle East Africa, Russia,

Ukraine and South America, connecting Cellnet to countries they currently don’t

sell into.

More recently (07/09/2018)

Cellnet purchased Turn Left, a warehouse and distribution company focusing on

gaming software and accessories for $6 mill. Turn Left currently outsources its

warehousing and with parallel retail partners (eg. Jb Hifi, Noel Lemming etc.)

Cellnet has ample opportunities for synergies. Turn

Left being a reputable company with distribution rights to companies such as Thrustmaster,

Steelseries, Plantronics and Kontrol Freek gives Cellnet easy access to this

lucrative and expanding (estimated 6.1% CAGR 2018-2026) market.

Gaming Hardware

Growth Rate (Source: Transparency Market Research)

Management

Complementing Mr. Alan Spark’s 40

years experience, Mr Michael Wendt (Chairman & Non-Executive Director) has

over 26 years in international retail and distribution experience. Mr Tony

Pearson (Non-Executive independent Director) has many years of board and

committee experience. Mr Michael Reddie (Non-Executive Independent Director) the

current director of Reddie Lawyers has experience in consulting clients in

M&A, Corporate Governance, Joint Ventures and strategic alliances both

domestically and internationally. Rounding out the experience board is Mr Kevin

Gilmore (Non-Executive Director) who is the current Director of Sales for

Wentronic Asia Pacific brings with him experience in management positions at

multinational corporations such as GE, Shell, Philips Electronics and Belkin.

Competition

Cellnet’s currently has limited

competition and due to this, there is little information regarding market size

and share. Force Technology International, a

privately owned company, is their main Australian competition. They work in the

same telecommunication space as Cellnet, offering cases, screen protectors etc

to their clients. Other notable competitors are Ingram Micro Ltd and Synnex

Corporation. While there is limited information regarding Cellnet’s market

share, it is my belief that they currently control a large section of the

market. They have the sole distribution rights to Optus, Vodafone, Noel Leeming

and Lagardere, they also supply all the big retailers such as JB Hifi, Kmart

etc. and are also taking advantage of the online space, selling on websites

such as Amazon and Ebay.

As there is no direct competition

to compare Cellnet to, evaluation is quite hard. It’s my belief that under such

circumstances caution is called for and I would only invest under excellent

circumstances. Below is a section of the evaluation metrics that I use, as you

can see, Cellnet has quite good scores for the traditional value metrics, .27

Price to Sales, 1.1 Price to Tangible Book, 7.08 Price to Normalised Earnings.

Along with these great values, Cellnet currently has a Pitroski Score of 8 and

a Z score of 7.72.

Catalyst

As the common aphorism states “A

raising tide lifts all ships” the inverse of this is just as true. The recent

uncertainty about the US/China trade war and the general concern of the global

economy reaching the final stages of the bull market, has resulted in stock

markets around the world reducing collectively. Despite all of the recent

changes, the acquisition of Turn Left, the joint venture between Cellnet and

Wentronic, JEJ becoming a strategic partner, the reduction in debt of 3.9 mill

and the increase in normalised profit of 34%, the market is currently pricing

Cellnet at only 5 million more than it was worth a year ago. Over the long

term, I believe the market will see the true worth of Cellnet and the price

will reflect it.

Reason to not invest

As a large percentage of shares

are owned by insiders, this reduces liquidity and some people would therefore

demand a premium. One of the main reasons for this is because the owner has

little to no influence on the shareholder votes, no large blocks can be

purchased and therefore you are essentially just going along for the ride. In

cases such as this, management has far more importance than usual, while it is

paramount that any business you purchase has reputable management, buying into

a company where your vote will do little to nothing, means that you must have

absolute faith in the management team.

Along with the low liquidity,

across the world there is a general consensus that we are nearing the final

stages of the bull market. This has many investors worried, causing them to move

their money into safer assets, driving stock prices lower. This worry is

especially true in Australia where we have low household savings rates, low

wage growth, high household debt, house prices falling sharply (mostly in the

east coast capitals) and a reduction in Chinesse demand for Australian

resources, is causing many households to tighten their purse strings. This will

have a negative and dramatic impact on the discretionary spending, where once

people may have upgraded their gaming hardware or phone, they will postpone or

stop all together these purchases. This will have a flow on effect to Cellnet

as their suppliers purchase less and less products.

Recommendation

The low liquidity to many would

seem as a reason not to invest, however if you are a long term investor seeing

the purchase as part ownership in a business than this is something that should

not concern you. As Charlie Munger says “The big money is not in the buying and

selling, but in the waiting”.

Cellnet is a turnaround story;

one that I believe has been playing out long enough to prove that it’s not just

a short term effect. They have increased their product range and further

diversified their risk by pushing their products onto the rest of the world. While

the global downturn, further exacerbated in Australia due to country specific

conditions, is a real risk to Cellnet, I believe they have positioned

themselves well to weather this storm and it is due to these conditions that

Cellnet has reduced to a price that I believe offers real value.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion of Cellnet, given this, they

may be subject to one or a number of biases, more specifically anchoring and/or

confirmation bias. This article is neither general nor personal advice and in no way

constitutes specific or individual advice. The website and author do not

guarantee, and accept no legal liability whatsoever arising from or connected

to, the accuracy, reliability, currency or completeness of any material

contained on this website or on any linked site. This website is not a

substitute for independent professional advice and users should obtain any

appropriate professional advice relevant to their particular circumstances. The

material on this website may include the views or recommendations of third

parties, which do not necessarily reflect the views of the website or author,

or indicate its commitment to a particular course of action

Follow @MaysTrav

Description

Cellnet (ASX:CLT), formed in 1992, is a market leader in the warehouse and distribution industry with centres in Australia, China and New Zealand. Their main source of revenue is warehousing and distribution, however they also own the 3SIXT technology brand, selling everything from phone covers and screen protectors to action video cameras. They are currently the exclusive supplier to Optus, Vodafone, Noel Leeming and Lagardere, where they manage each peg, giving Cellnet up to date information on stock levels and customer preferences.

Cellnet by 2014 had become

unfocused, increasing the number of brands in their fold to 72. As with Icarus, the wings that were originally their source of

success, lead to their eventual downfall. Whilst the additional brands were

bringing in more revenue, Cellnet’s expenses accelerated at a faster pace,

culminating in a large loss in 2014 and the removal of the then current CEO and

appointment of Alan Sparks to replace him.

Cellnet under the excellent

management of Alan Sparks, have achieved a remarkable feat, as Warren Buffett

says “Turnarounds seldom Turn”, Cellnet, defying the odds, falls into the

seldom group. Mr. Sparks began by cutting the expenses and streamlining the

business, reducing the number of brands to just 12 in 2014. Despite the smaller

number of brands, Cellnet has modestly increased revenue, however their

greatest achievement has been in the reduction of expenses. This is seen

through the large disparity in revenue to profit growth, revenue grew an

average of 5.2% pa whilst profit grew an average of 15.9% pa. These numbers are

heavily affected by the loss in 2014 and the subsequent recovery of 2015. A

better representation of Mr. Sparks and his team’s efforts is the last three

years, where they have achieved an average per annum revenue and profit growth

of 4.6% and 25.1% respectively.

To further help Cellnet reach its

potential, a partner was sought who not only understood the business, but would

bring with them knowledge and synergies, they found WentronicHolding GmbH. Wentronic purchased 79.77% (56.19%, 2018) of Cellnet in

2016 and with it, it brought over 25

years of knowledge and experience operating a similar and considerably larger

business than Cellnet. Wentronic is a privately owned warehouse and

distribution company with over 300 staff, 12000 products and 5 branches

throughout Europe and Asia. Wentronic opened up supply chain channels that

Cellnet couldn’t have gained alone, contributing significantly to the reduction

in expenses. Further to this, Wentronic and Cellnet in 2018 entered into a

joint venture company (51% Wentronic, 49% Cellnet) incorporated in Singapore,

Wentronic International Pte. Ltd. The purpose of which is to expand the

Wentronic and Cellnet products into markets outside Europe, Australia and New

Zealand, with both companies proportionately picking up the bill.

This joint venture coincided with

another development in 2018, 11.4% of Cellnet’s shares were purchased by a

strategic Partner JEJ, the investment vehicle of Cybernetic

of Taiwan. Cybernetic has been distributing Philips (Mr. Sparks worked for

Philips for over 7 years) accessories since 1993, shipping to many counties

including Taiwan, Turkey, Middle East Africa, Russia,

Ukraine and South America, connecting Cellnet to countries they currently don’t

sell into.

More recently (07/09/2018)

Cellnet purchased Turn Left, a warehouse and distribution company focusing on

gaming software and accessories for $6 mill. Turn Left currently outsources its

warehousing and with parallel retail partners (eg. Jb Hifi, Noel Lemming etc.)

Cellnet has ample opportunities for synergies. Turn

Left being a reputable company with distribution rights to companies such as Thrustmaster,

Steelseries, Plantronics and Kontrol Freek gives Cellnet easy access to this

lucrative and expanding (estimated 6.1% CAGR 2018-2026) market.

Gaming Hardware

Growth Rate (Source: Transparency Market Research)

Management

Complementing Mr. Alan Spark’s 40

years experience, Mr Michael Wendt (Chairman & Non-Executive Director) has

over 26 years in international retail and distribution experience. Mr Tony

Pearson (Non-Executive independent Director) has many years of board and

committee experience. Mr Michael Reddie (Non-Executive Independent Director) the

current director of Reddie Lawyers has experience in consulting clients in

M&A, Corporate Governance, Joint Ventures and strategic alliances both

domestically and internationally. Rounding out the experience board is Mr Kevin

Gilmore (Non-Executive Director) who is the current Director of Sales for

Wentronic Asia Pacific brings with him experience in management positions at

multinational corporations such as GE, Shell, Philips Electronics and Belkin.

Competition

Cellnet’s currently has limited

competition and due to this, there is little information regarding market size

and share. Force Technology International, a

privately owned company, is their main Australian competition. They work in the

same telecommunication space as Cellnet, offering cases, screen protectors etc

to their clients. Other notable competitors are Ingram Micro Ltd and Synnex

Corporation. While there is limited information regarding Cellnet’s market

share, it is my belief that they currently control a large section of the

market. They have the sole distribution rights to Optus, Vodafone, Noel Leeming

and Lagardere, they also supply all the big retailers such as JB Hifi, Kmart

etc. and are also taking advantage of the online space, selling on websites

such as Amazon and Ebay.

As there is no direct competition

to compare Cellnet to, evaluation is quite hard. It’s my belief that under such

circumstances caution is called for and I would only invest under excellent

circumstances. Below is a section of the evaluation metrics that I use, as you

can see, Cellnet has quite good scores for the traditional value metrics, .27

Price to Sales, 1.1 Price to Tangible Book, 7.08 Price to Normalised Earnings.

Along with these great values, Cellnet currently has a Pitroski Score of 8 and

a Z score of 7.72.

Catalyst

As the common aphorism states “A

raising tide lifts all ships” the inverse of this is just as true. The recent

uncertainty about the US/China trade war and the general concern of the global

economy reaching the final stages of the bull market, has resulted in stock

markets around the world reducing collectively. Despite all of the recent

changes, the acquisition of Turn Left, the joint venture between Cellnet and

Wentronic, JEJ becoming a strategic partner, the reduction in debt of 3.9 mill

and the increase in normalised profit of 34%, the market is currently pricing

Cellnet at only 5 million more than it was worth a year ago. Over the long

term, I believe the market will see the true worth of Cellnet and the price

will reflect it.

Reason to not invest

As a large percentage of shares

are owned by insiders, this reduces liquidity and some people would therefore

demand a premium. One of the main reasons for this is because the owner has

little to no influence on the shareholder votes, no large blocks can be

purchased and therefore you are essentially just going along for the ride. In

cases such as this, management has far more importance than usual, while it is

paramount that any business you purchase has reputable management, buying into

a company where your vote will do little to nothing, means that you must have

absolute faith in the management team.

Along with the low liquidity,

across the world there is a general consensus that we are nearing the final

stages of the bull market. This has many investors worried, causing them to move

their money into safer assets, driving stock prices lower. This worry is

especially true in Australia where we have low household savings rates, low

wage growth, high household debt, house prices falling sharply (mostly in the

east coast capitals) and a reduction in Chinesse demand for Australian

resources, is causing many households to tighten their purse strings. This will

have a negative and dramatic impact on the discretionary spending, where once

people may have upgraded their gaming hardware or phone, they will postpone or

stop all together these purchases. This will have a flow on effect to Cellnet

as their suppliers purchase less and less products.

Recommendation

The low liquidity to many would

seem as a reason not to invest, however if you are a long term investor seeing

the purchase as part ownership in a business than this is something that should

not concern you. As Charlie Munger says “The big money is not in the buying and

selling, but in the waiting”.

Cellnet is a turnaround story;

one that I believe has been playing out long enough to prove that it’s not just

a short term effect. They have increased their product range and further

diversified their risk by pushing their products onto the rest of the world. While

the global downturn, further exacerbated in Australia due to country specific

conditions, is a real risk to Cellnet, I believe they have positioned

themselves well to weather this storm and it is due to these conditions that

Cellnet has reduced to a price that I believe offers real value.

Thanks for reading

Just Culture Investor

Trav Mays

The author is a current owner of a portion of Cellnet, given this, they

may be subject to one or a number of biases, more specifically anchoring and/or

confirmation bias. This article is neither general nor personal advice and in no way

constitutes specific or individual advice. The website and author do not

guarantee, and accept no legal liability whatsoever arising from or connected

to, the accuracy, reliability, currency or completeness of any material

contained on this website or on any linked site. This website is not a

substitute for independent professional advice and users should obtain any

appropriate professional advice relevant to their particular circumstances. The

material on this website may include the views or recommendations of third

parties, which do not necessarily reflect the views of the website or author,

or indicate its commitment to a particular course of action